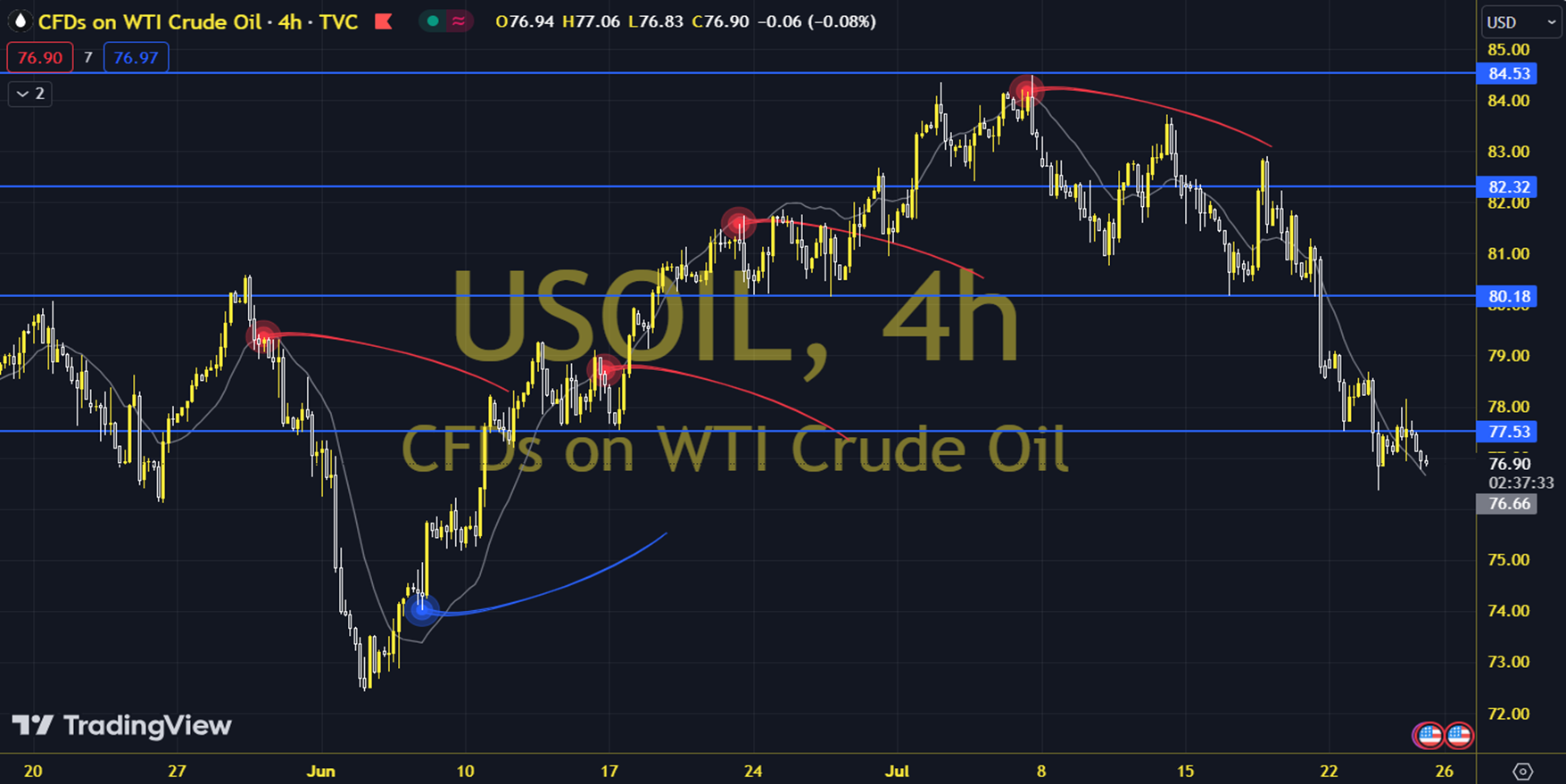

WTIUSD

Although oil futures started the week with a limited increase along with the Middle East agenda, we saw that pricing was balanced after the opening with the inclusion of ongoing concerns about Chinese demand. Following the attack on the Israeli-occupied Golan Heights, concerns that the conflict environment could expand have come to the fore again. The course of European and US stock markets can be followed during the day. On the WTI side, a downward trend parallel to Brent oil is dominant. WTI oil saw a high of 79.20 and a low of 76.82 on the previous trading day. The 78.72 level can be followed in intraday upward movements. If this level is exceeded, the 79.33 and 80.00 resistances may become important. In possible pullbacks, 77.55 and 76.88 will be monitored as support levels. Support: 77.55 – 76.88 Resistance: 78.72 – 79.33