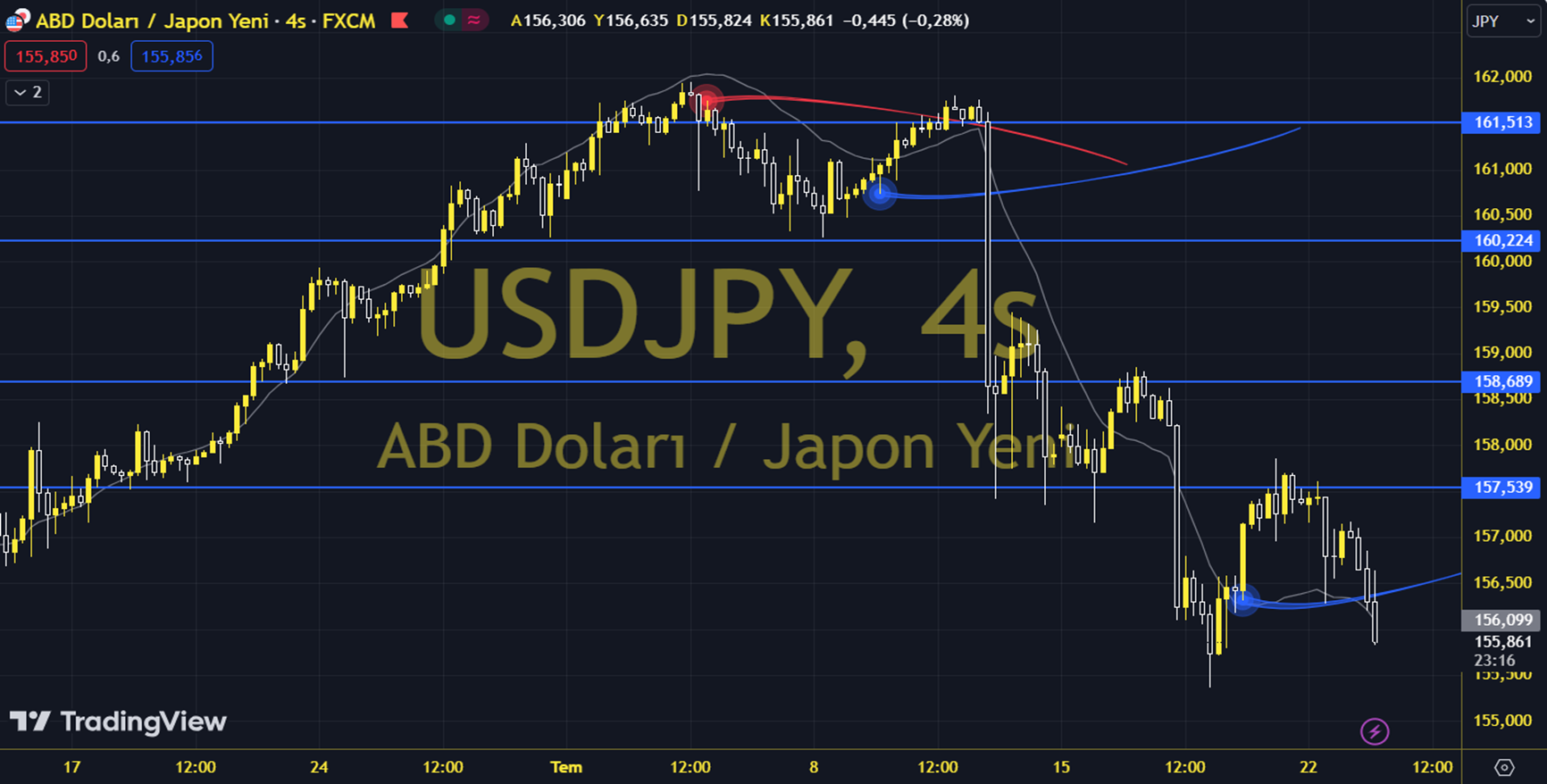

USDJPY

USD/JPY is falling rapidly from its highs from early July. After peaking at 161.95 on July 3, it fell to 154.50 on the back of the Japanese Yen intervention. The breakout of the main trendline at 158.45 on July 13 was a game-changer for the pair, and when taken together with the more recent break below the July low of 152.15, it gave the chart a much more bearish outlook. The pair closed at 152.51 on the previous trading day, with a daily loss of 0.89%. The pair, which is below its 20-day moving average, has an RSI of 25.09, while its momentum is at 94.53. Intraday upside moves can be followed at 153.58. If this level is passed, resistance levels of 154.64 and 155.32 may become important. In case of possible pullbacks, support levels of 151.84, 151.17 and 150.10 will be monitored. Support: 151.840 – 151,170 Resistance: 153.580 – 154.640