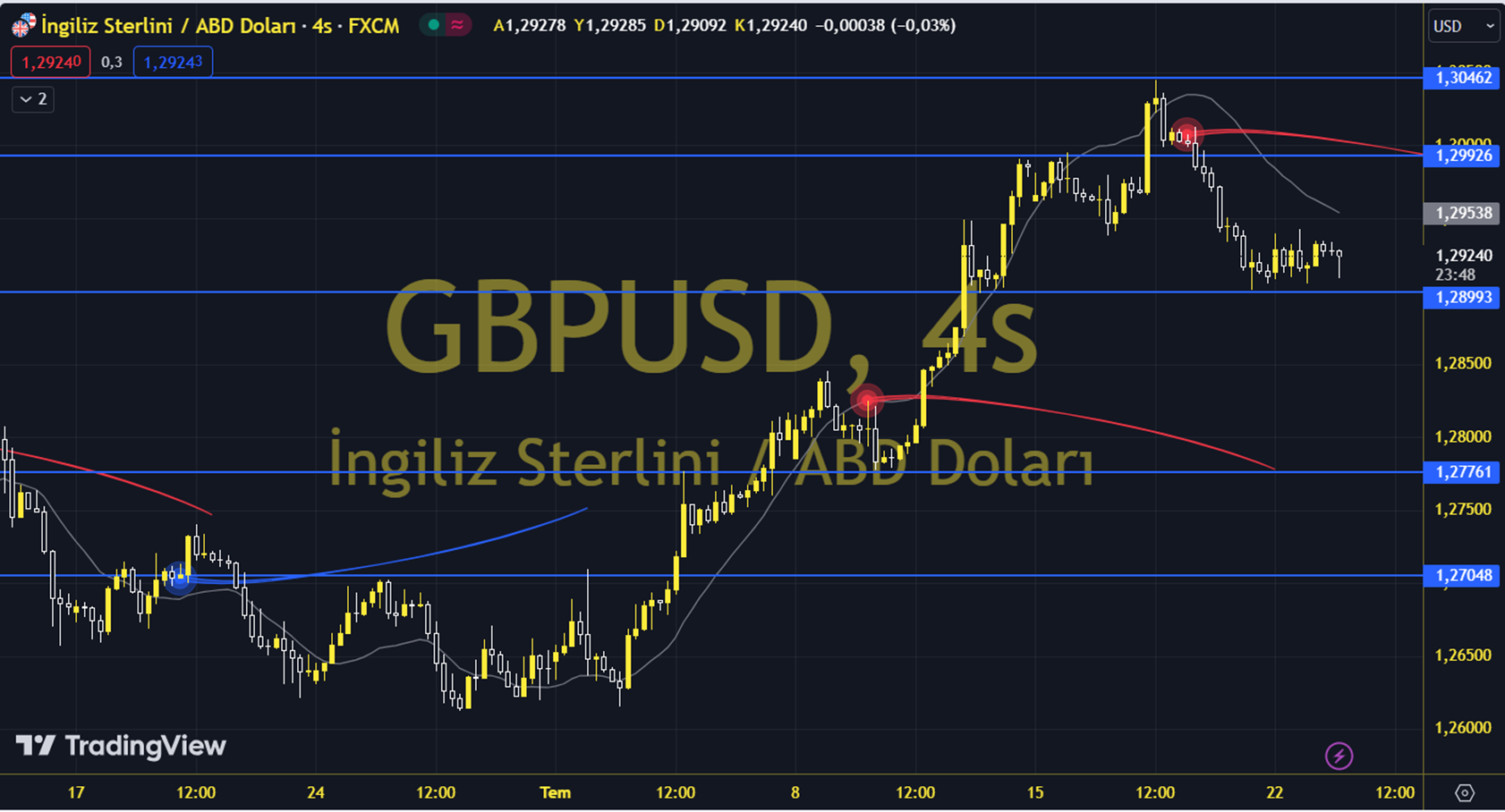

GBPUSD

The most important macro development in the midweek was the Manufacturing PMI data, where the contraction rate of the Euro Zone and the locomotive country of Europe, Germany, increased, and the US, which continued its growth pace in the Service sector but returned to the contraction zone in the Manufacturing sector. Following yesterday's PMI data, we will carefully follow today's US 2nd Quarter Growth (First Reading) and ECB President Lagarde's speech, and tomorrow's Fed's Inflation indicator PCE (Personal Consumption Expenditure) data. The daily loss for the parity, which closed at 1.2889 on the previous trading day, was 0.16%. The RSI indicator for the parity, which is below its 20-day moving average, is at 56.17, while its momentum is at 100.80. The 1.2897 level can be followed in intraday upward movements. If this level is exceeded, the 1.2908 and 1.2927 resistances may become important. In case of possible pullbacks, 1.2878, 1.2867 and 1.2848 will be monitored as support levels. Support: 1.2878 – 1.2867 Resistance: 1.2897 – 1.2908