DXY

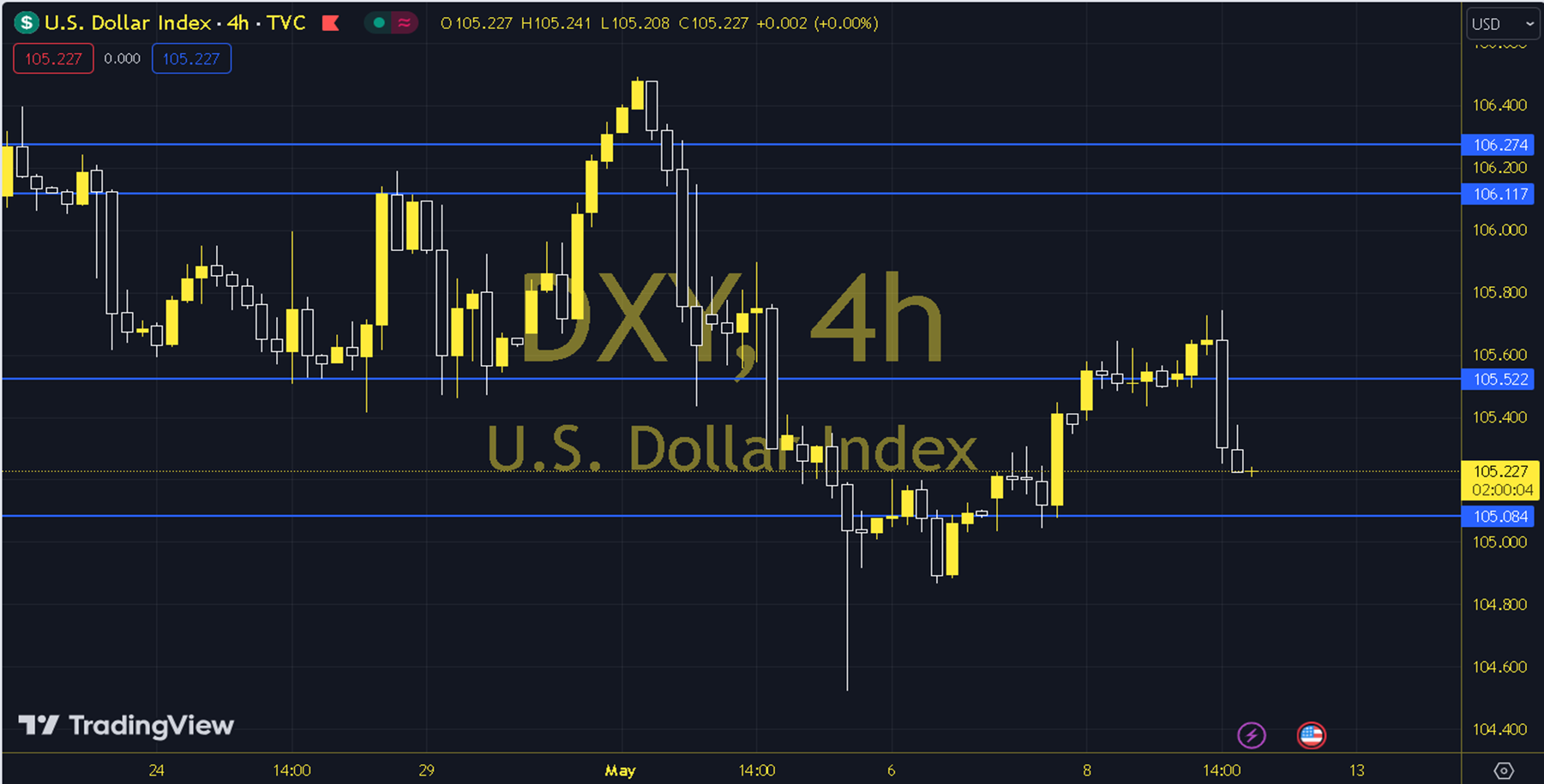

While our main focus before the June meeting where we can comment on the pace of the US Federal Reserve until the end of the year will be the CPI data on Wednesday, May 15, we are leaving behind a quiet week in terms of data before inflation. In particular, the fact that the Classic Dollar Index accepted the 34-day average as the bottom and continued its course above the 34 and 100-day averages (104.25 - 104.98 region) supported the strong Dollar stance before the CPI. For now, the Classic Dollar Index keeps on the table the expectation of reaching the 107 level tested in 2023 on the 34 and 100-day averages. The 105.360 level can be followed in intraday downward movements. If this level is dropped, the support of 105.110 may become important. In possible increases, 105,680 and 105,950 will be monitored as resistance levels. Support: 105,360-105,110 Resistance: 105,680-105,950