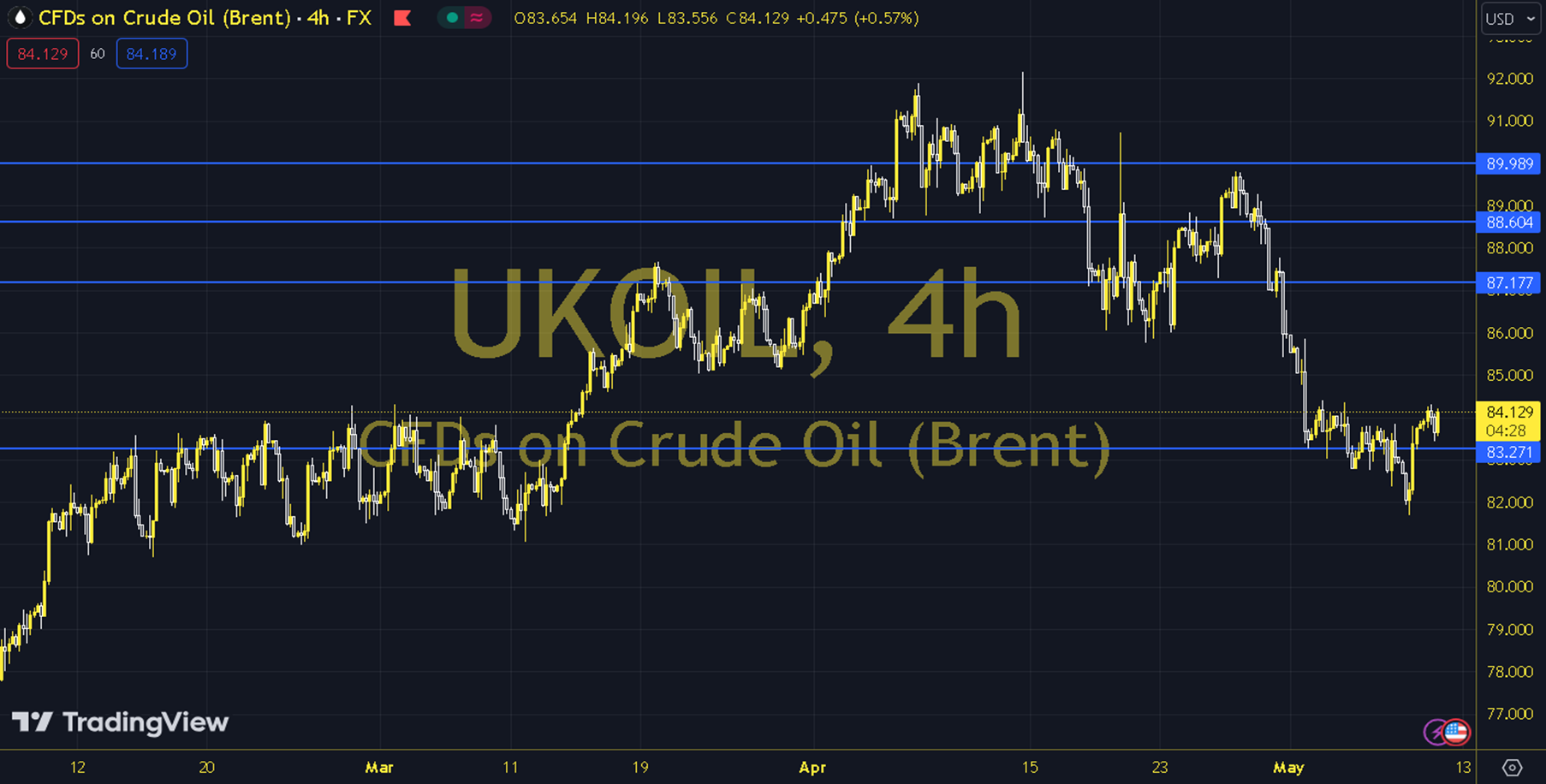

BRENT

With the decline in stocks in the US, the rise in oil futures contracts is trying to continue. We will be following the course of European and US stock exchanges during the day. Brent oil saw a high of 84.05 and a low of 83.21 on the previous trading day. Following the upward break of the downward channel, the effort to hold on to short-term averages continues. As long as pricing remains at and above the 83.00 - 83.50 support supported by the 13 and 20-period exponential moving averages during the day, an upward outlook may be at the forefront. In possible increases, 85.00 and 85.50 levels may be targeted. As long as the 83.00 - 83.50 support remains current in pullbacks, new upside potential may occur. Therefore, it may be necessary to see the course below 83.00 and 4-hour closings for the continuation of the downward desire. In this case, 82.50 and 82.00 levels may come to the agenda. Support: 83.50 – 83.00 Resistance: 85.00 – 85.50