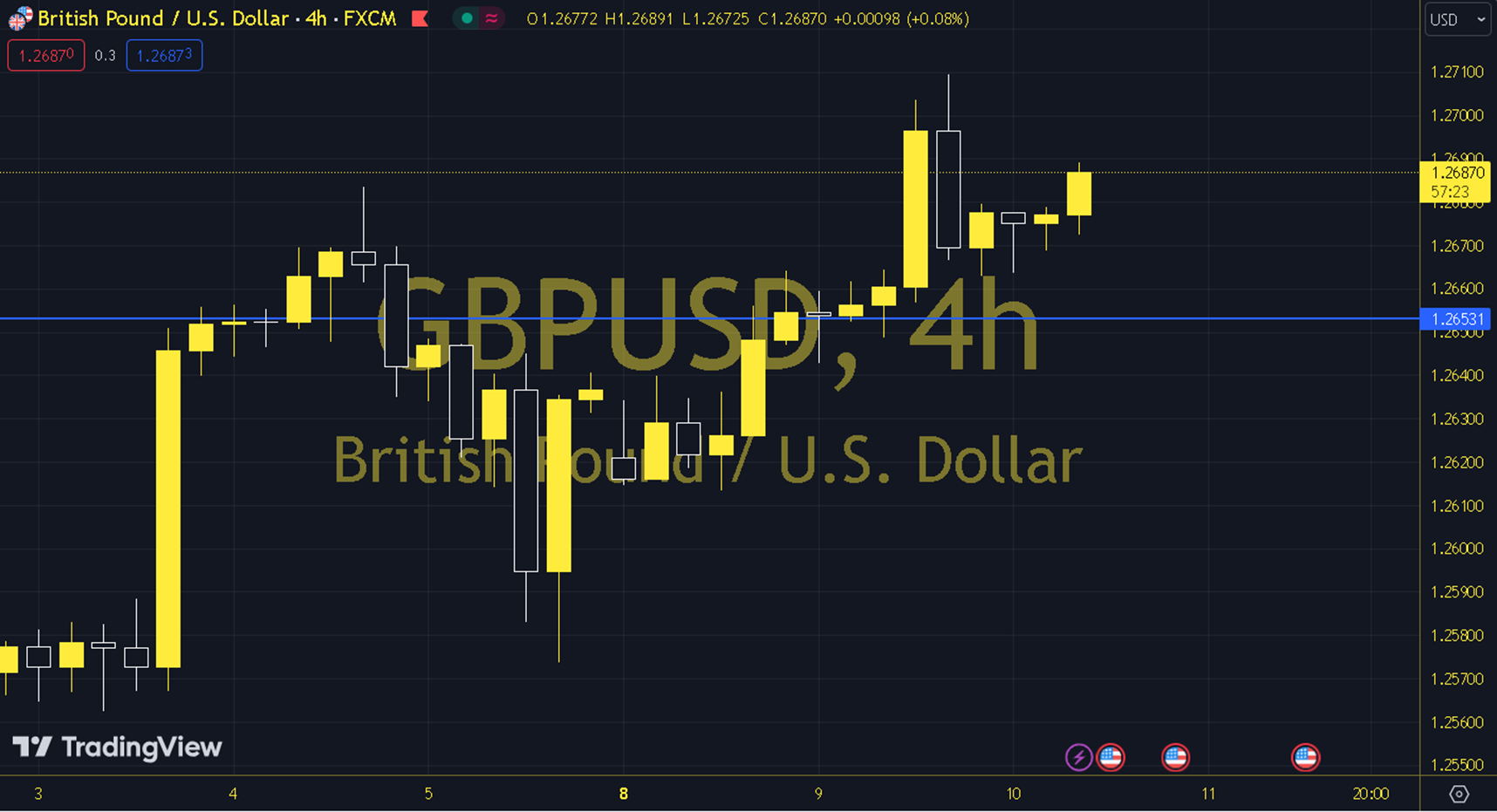

GBPUSD

We are on the most important day of the week. Today, global markets will focus on the March Headline and Core CPI data from the US and the FOMC meeting minutes, which include details of the March meeting. When we evaluate the GBPUSD parity in the short term, we see that the negative trend that started in the 1.29 region is in the final stages according to recent movements. The macro indicators with high significance during the day are important for the answer to the question of whether the new positive expectation or the old negative trend is effective for the parity. In this process, the price reference levels can be monitored as 1.2635 and 1.2680. With permanent movements above 1.2680, the parity can change its trend and wink at the 1.2875 level or continue its trend appearance with permanent movements below 1.2635 and create a new rally towards the 1.2400 level. Support: 1.2635 – 1.2605 Resistance: 1.2680 – 1.2710