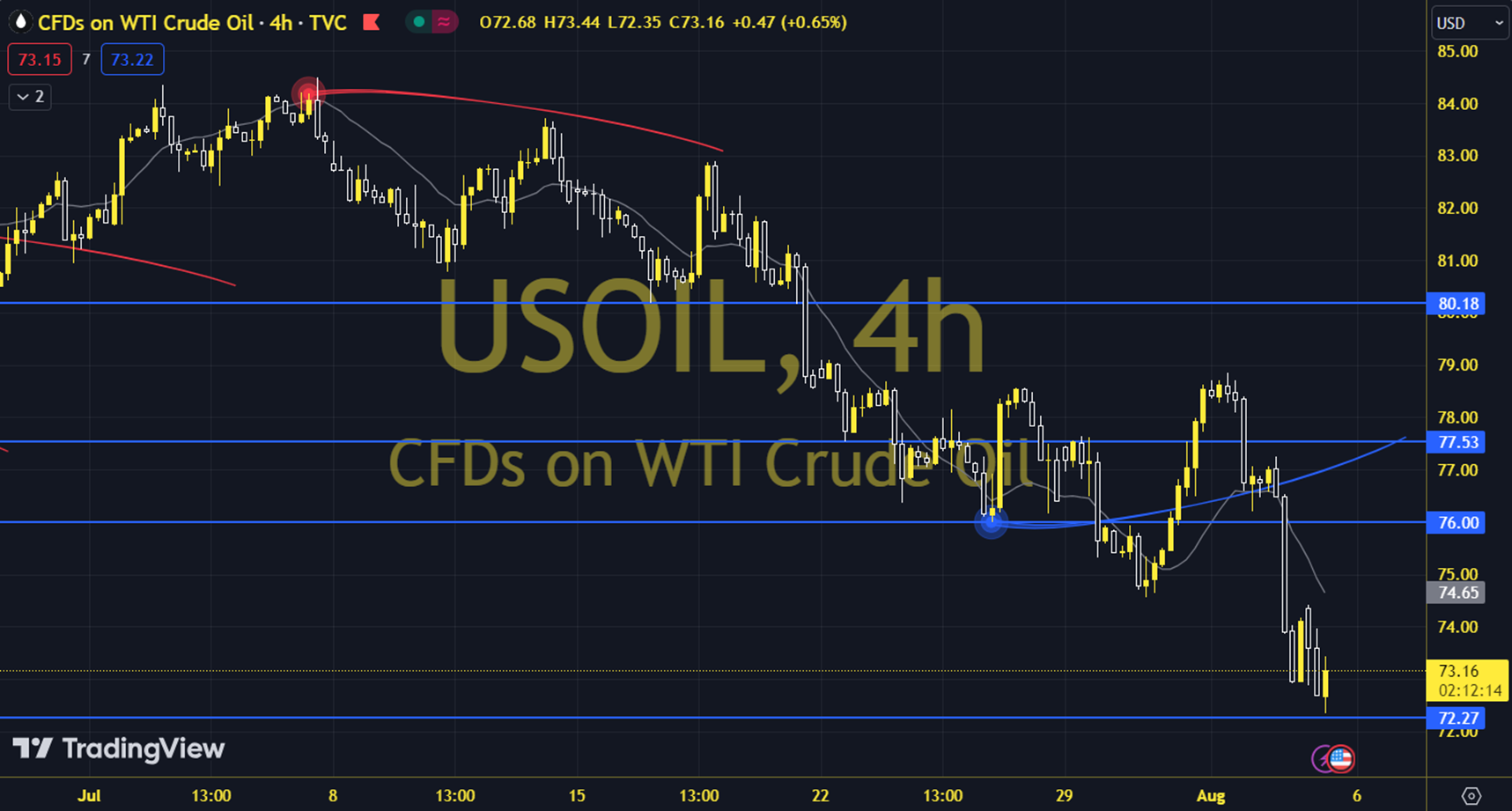

WTIUSD

Oil futures have shown an upward trend from the lowest levels seen since January-February due to the recovery efforts in stock markets. In addition to Asian indices and US stock exchanges that have shown an effort to recover after yesterday's sharp decline, the halt in production in Sharara, Libya's largest oil production field, due to internal conflicts, has also been effective in this picture. The course of European and US stock exchanges and the stock figures to be announced by the American Petroleum Institute can be followed during the day. A downward trend parallel to Brent oil is also dominant on the WTI side. WTI oil saw a high of 74.82 and a low of 72.18 on the previous trading day. The 73.84 level can be followed in intraday downward movements. If this level is dropped below, the supports at 71.85, 70.20 and 69.21 may become important. In possible increases, the resistance levels of 75.49, 76.48 and 77.13 will be monitored. Support: 73.84 – 72.85 Resistance: 75.49 – 76.48