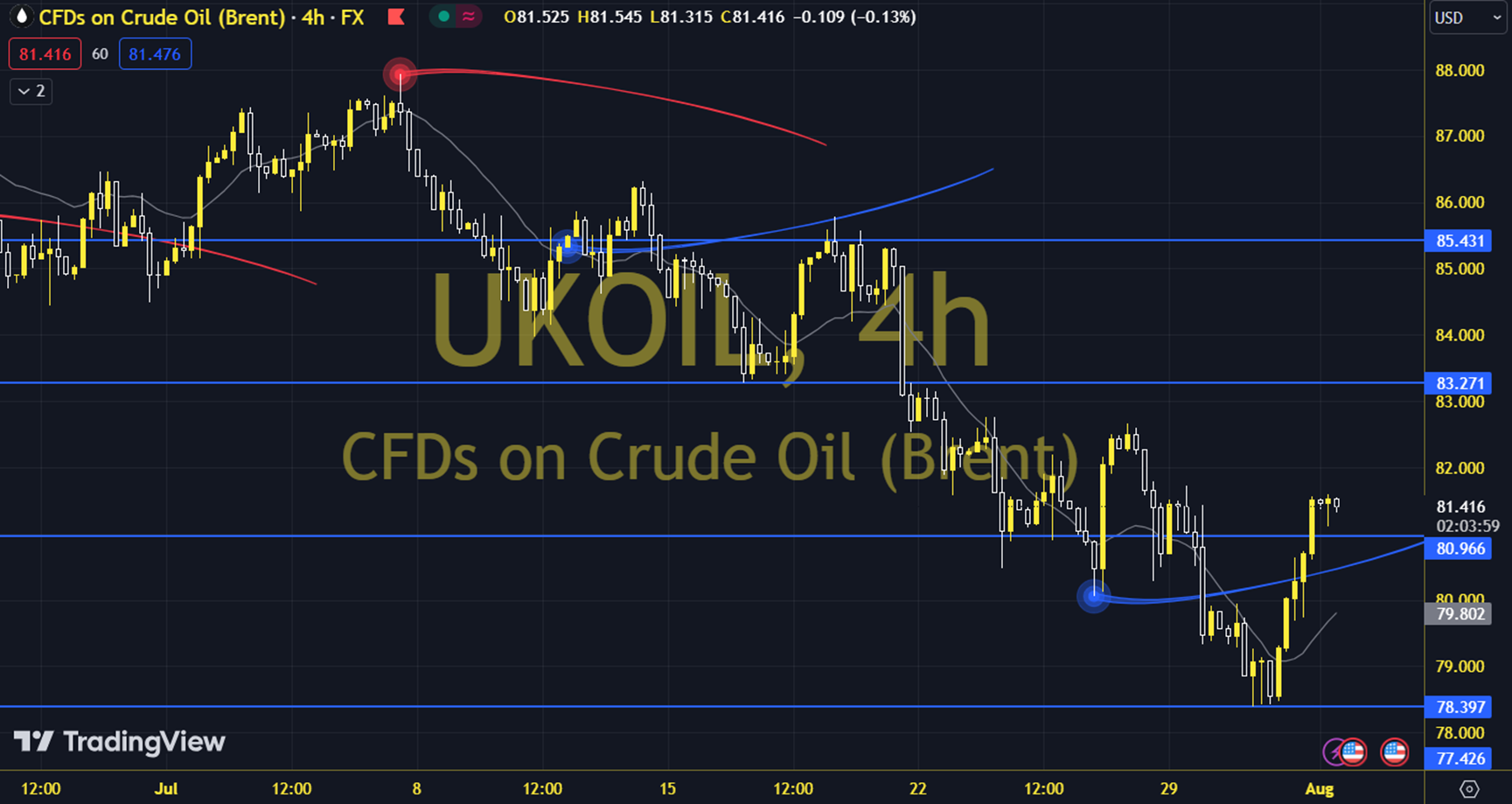

BRNUSD

Oil futures were under pressure last week due to weak US data that triggered concerns about a recession in the global economy. It was observed that the pressure continued due to the negative impact of the expectation of an Iranian attack on Israel on the economies rather than supply-side concerns. The course of European and US stock markets can be followed during the day. It is seen that there is a general downtrend. Brent oil saw a high of 80.31 and a low of 76.31 on the previous trading day. Brent oil, which followed a selling trend on the last trading day, lost 3.26% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 33.83, while its momentum is at 91.66. The 77.98 level can be followed for intraday upward movements. If this level is exceeded, the resistances of 79.66, 81.99 and 83.67 may become important. In case of possible pullbacks, 75.65, 73.98 and 71.65 will be monitored as support levels. Support: 75.65 – 73.98 Resistance: 77.98 – 79.66