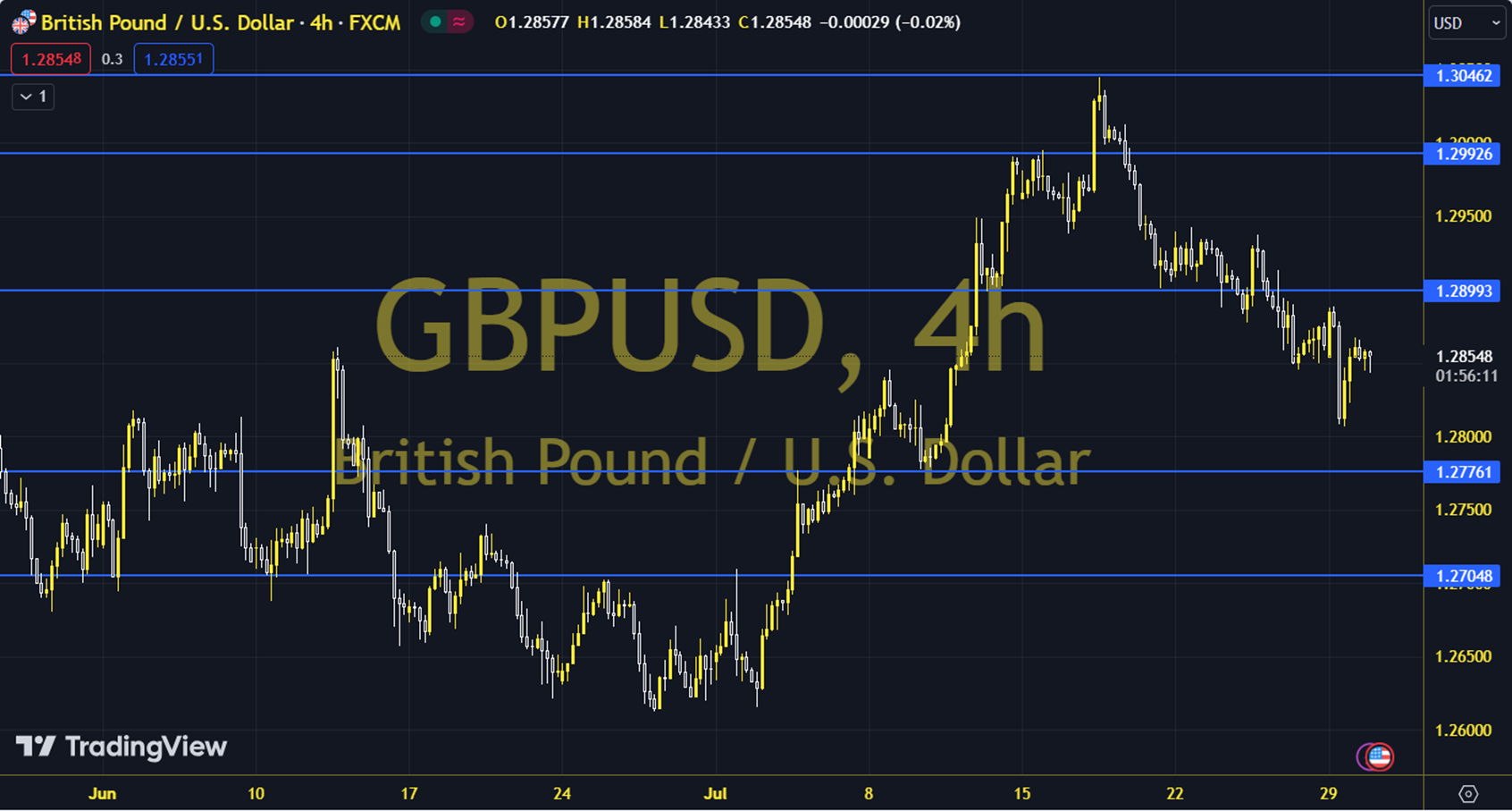

GBPUSD

The main focus of the markets will be on Fed Chair Powell's speech. The Fed is not expected to make any changes on the interest rate front at this meeting. In light of the latest indicators, we will be following Powell's guidance in answering the question of whether a rate cut will start in September and a projection will be presented that will end the year with 2 interest rate cuts rather than 1. Before Powell's speech, CPI from the Eurozone, ADP Private Sector Employment from the US and Pending Home Sales can be explained as other developments to be followed. The daily gain for the parity, which closed at 1.2843 on the previous trading day, was 0.05%. The RSI indicator for the parity, which is below its 20-day moving average, is at 50.19, while its momentum is at 99.04. The 1.2830 level can be followed in intraday downward movements. In case of falling below this level, the supports at 1.2816 and 1.2804 may become important. In possible increases, 1.2855, 1.2867 and 1.2881 will be monitored as resistance levels. Support: 1.2830 - 1.2816 Resistance: 1.2855 - 1.2867