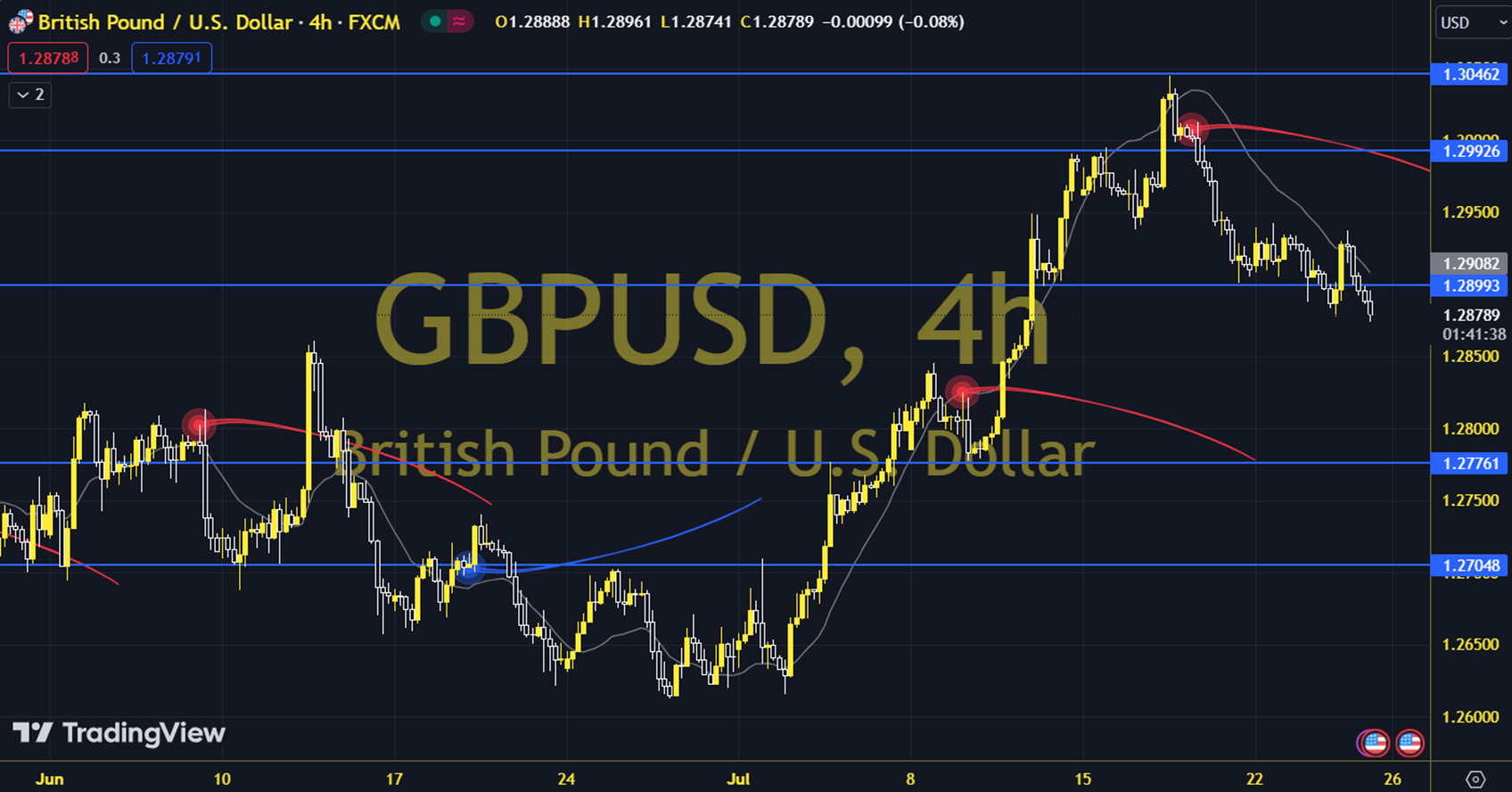

GBPUSD

On the last trading day of the week, the PCE data, which we know as the inflation indicator of the US Central Bank Fed, is expected to create an effective reaction on asset prices. The indicators are important for the answer to the question of whether they will put pressure on the Fed. While the desired progress in the growth rate and the decline in inflation increase the possibility of the Fed making another interest rate cut after September, it is important whether this idea will be supported by the PCE. In addition, the sensitivity of today's data increases for President Powell's messages. The daily gain for the parity, which closed at 1.2866 on the previous trading day, was 0.12%. The RSI indicator for the parity, which is below its 20-day moving average, is at 53.11, while its momentum is at 100.13. The 1.2855 level can be followed in intraday downward movements. In case of falling below this level, the 1.2837 supports may become important. In possible increases, 1.2879 and 1.2891 will be followed as resistance levels. Support: 1.2855 – 1.2837 Resistance: 1.2879 – 1.2891