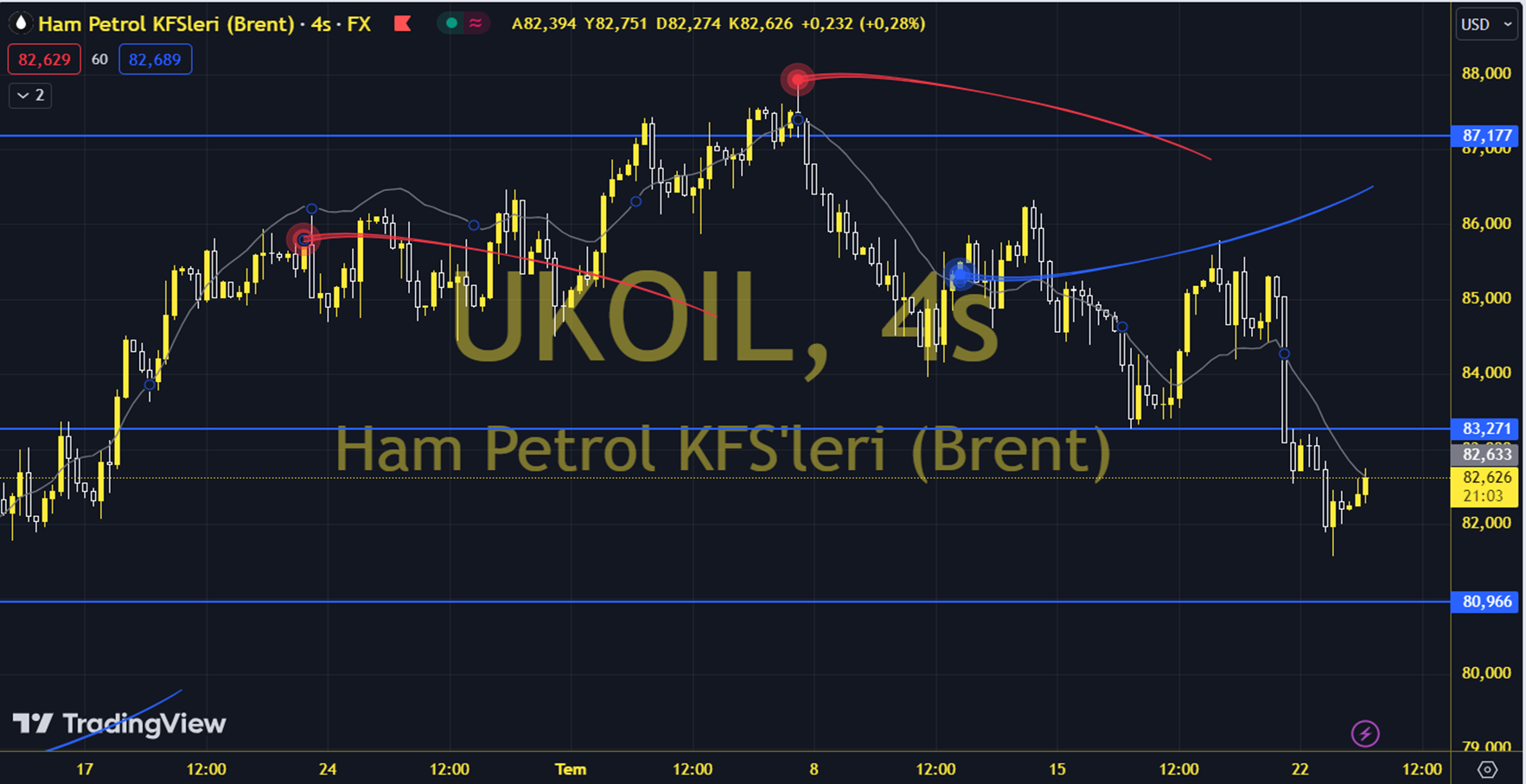

BRNUSD

Although the downward trend in oil was limited by the American Petroleum Institute's announcement of a 3.9 million barrel decrease in inventories, the overall depressed outlook is maintained with the weak demand outlook from China. If the decline is confirmed in the inventory data to be announced by the US Energy Information Administration today, this will indicate a decline for the third week in a row. In addition to the inventory data, leading manufacturing and services PMI data from Europe and the US can be monitored. In general, a downward trend is seen. Brent oil saw a high of 82.90 and a low of 80.79 on the previous trading day. Brent oil, which followed a selling trend on the last trading day, lost 0.98% daily. The 81.80 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 82.57 and 83.12 may become important. In possible pullbacks, 80.69, 79.88 and 79.17 will be monitored as support levels. Support: 80.69 – 79.88 Resistance: 81.80 – 82.57