BRENT

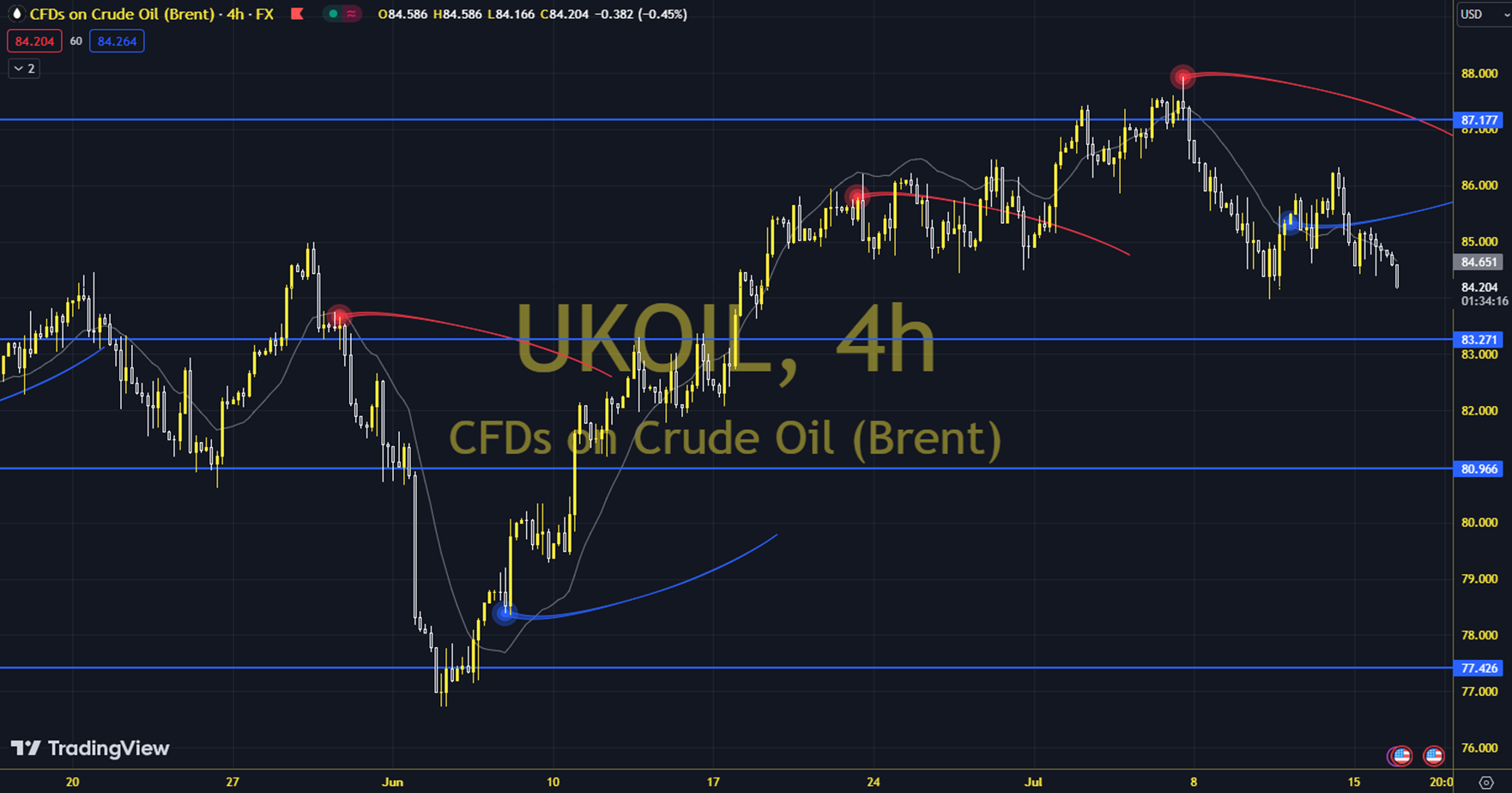

Oil futures were supported by data showing that crude oil stocks in the US continued to decline for the third week. The statement that the fires in Canada reduced the country's oil production by approximately 400 thousand barrels per day also supported this picture. The decline in the dollar index also contributed to this effect. The course of European and US stock exchanges can be followed during the day. In general, a downward trend is seen. Brent oil saw a high of 85.41 and a low of 83.79 on the previous trading day. Brent oil, which followed a buying trend on the last trading day, gained 1.52% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 49.63, while its momentum is at 97.54. The 84.86 level can be followed in intraday downward movements. If this level is dropped, the supports of 84.31 and 83.69 may become important. In possible increases, 85.93, 86.48 and 87.55 will be monitored as resistance levels. . Support: 84.86 – 84.31 Resistance: 85.93 – 86.48