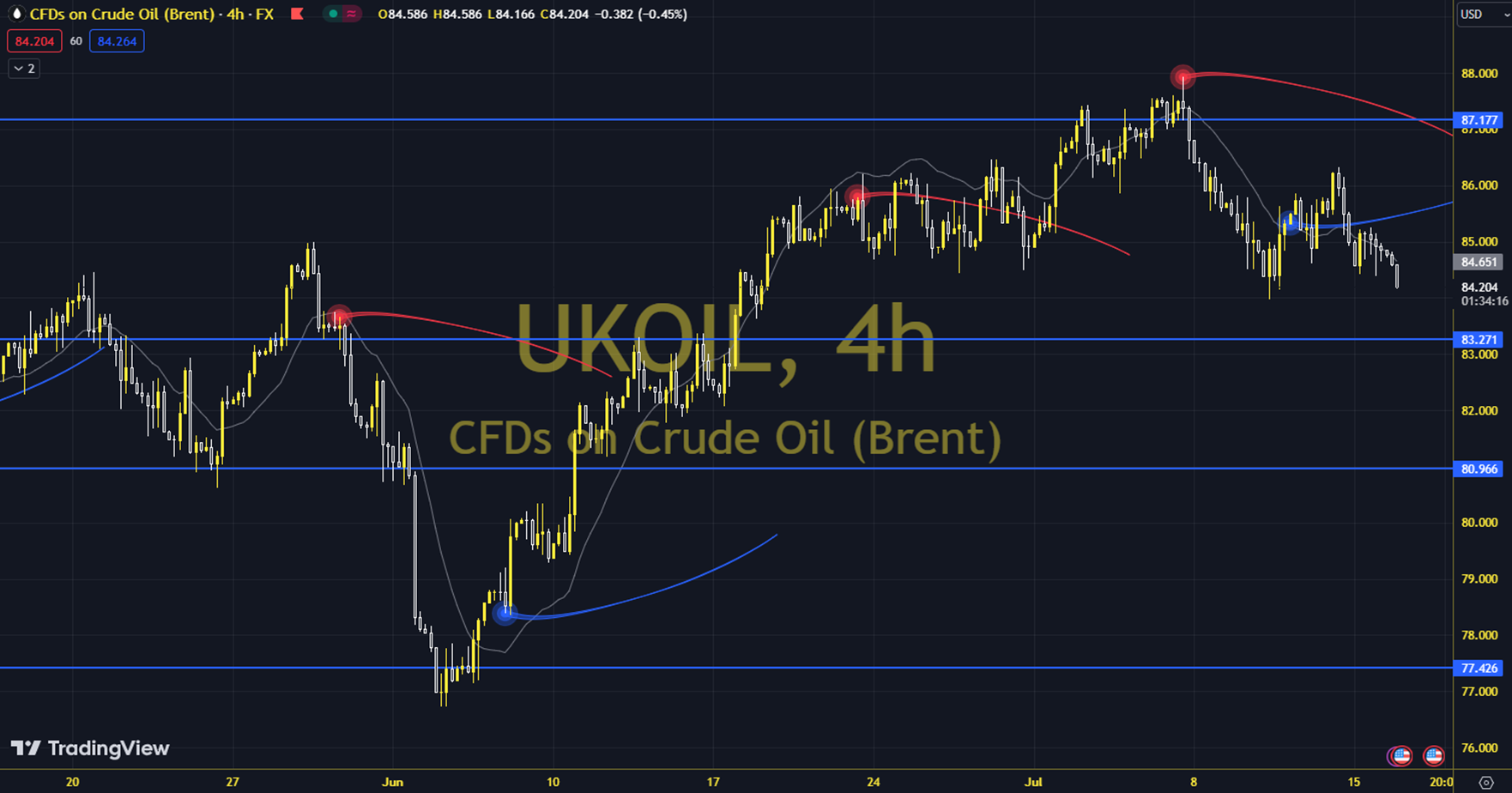

BRENT

Oil futures continued to remain under pressure, especially with the outlook for weakness in Chinese imports, despite the American Petroleum Institute's announcement of a 4.4 million barrel decrease in inventories. The course of European and US stock markets and the stock figures to be announced by the US Energy Information Administration can be followed during the day. In general, a downward trend is seen. Brent oil saw a high of 85.26 and a low of 83.71 on the previous trading day. Brent oil, which followed a selling trend on the last trading day, lost 1.38% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 42.57, while its momentum is at 97.93. The 84.36 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 85.00, 85.90 and 86.55 may become important. In possible pullbacks, 82.46, 81.82 and 80.92 will be monitored as support levels. Support: 82.46 – 81.82 Resistance: 84.36 – 85.00