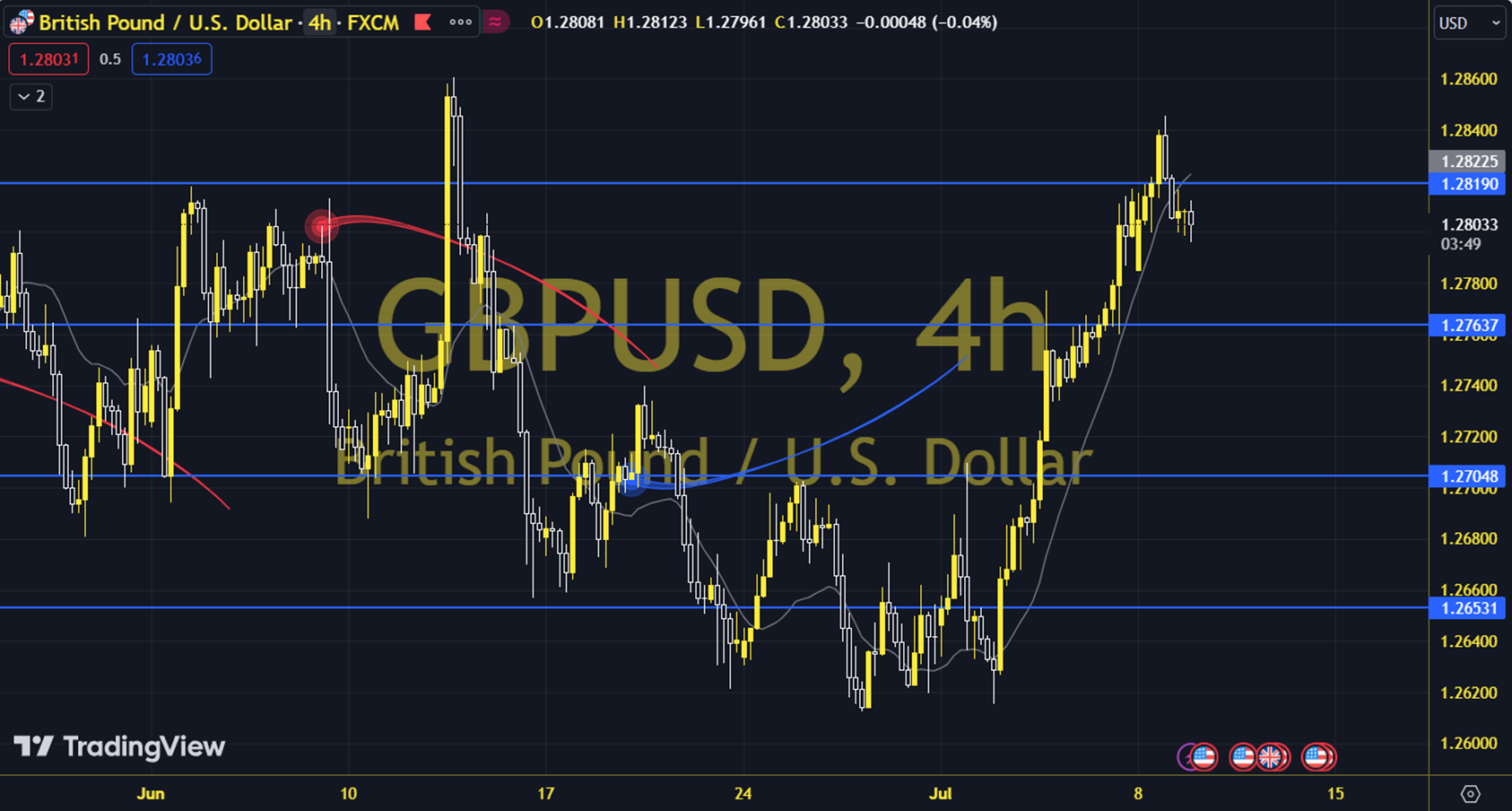

GBPUSD

We are in the middle of the week. On the one hand, the question mark of the coalition regarding the post-election economic decisions in France and the consecutive warnings from credit rating agencies, and on the other hand, the cautious statements of Fed Chair Powell regarding the interest rate cut occupy our agenda. After the Senate speech, we will also follow Fed Chair Powell's presentation in the House of Representatives today, but our main focus will be on the CPI data to come from the US on Thursday. The daily gain for the parity, which closed at 1.2794 on the previous trading day, was 0.05%. The RSI indicator for the parity, which is below its 20-day moving average, is at 60.99, while its momentum is at 100.85. The 1.2786 level can be followed in intraday downward movements. If this level is dropped, the supports of 1.2778 and 1.2773 may become important. In possible increases, 1.2799, 1.2804 and 1.2812 will be followed as resistance levels. Support: 1.2786 – 1.2778 Resistance: 1.2799 – 1.2804