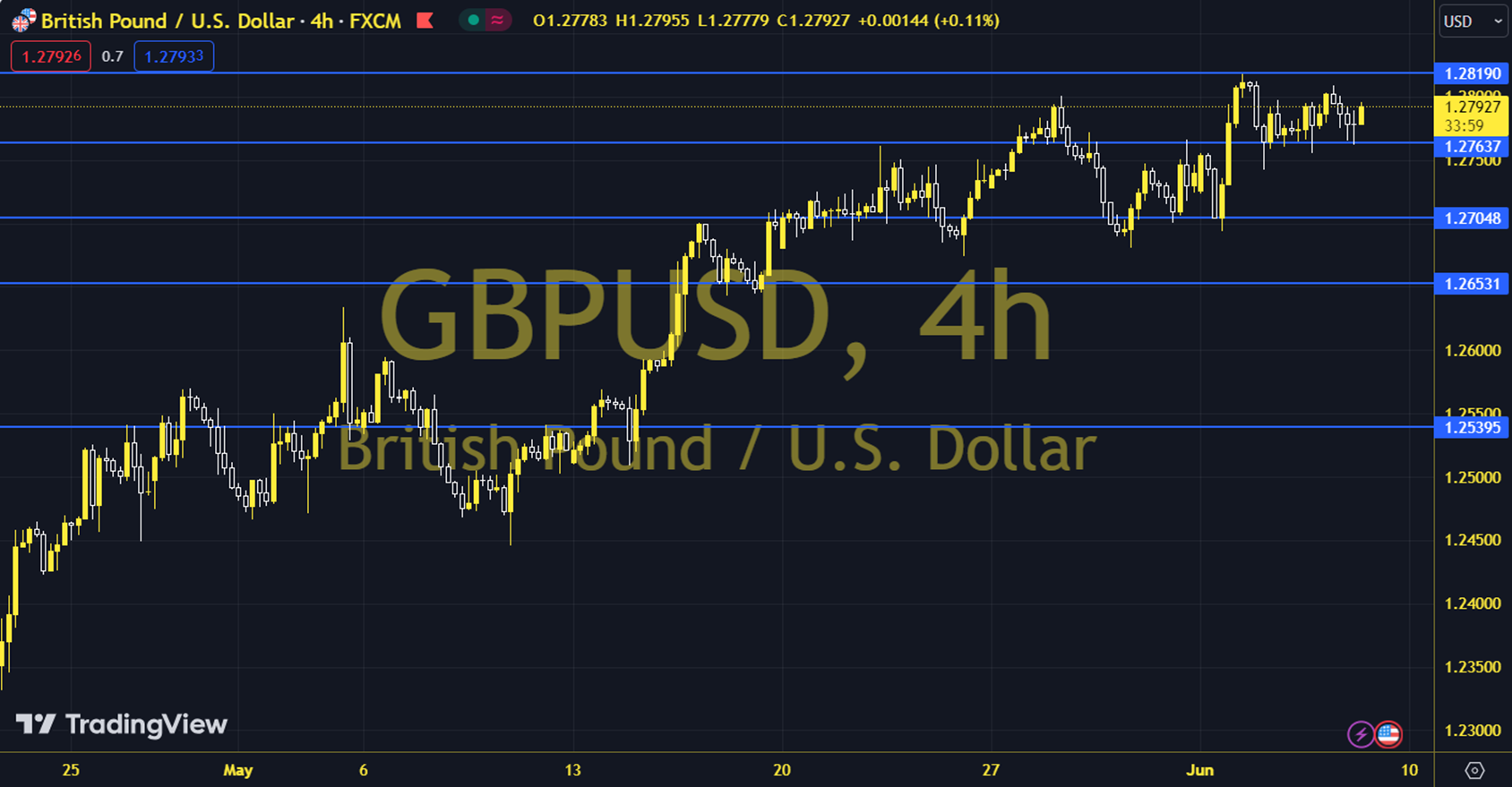

GBPUSD

We have entered the most critical day of June for global markets. Today, before the US session opens, we will follow the US CPI data for May to see if the rigidity in inflation continues, while our main focus will undoubtedly be on the Fed Interest Rate Decision, FOMC Economic Projections and Fed Chairman Powell's speech. In particular, the interest rate outlook in the Dot Plot section and then the messages that Fed Chairman Powell will give regarding the upcoming interest rate policy are expected to have an impact on most asset prices from A to Z. The daily loss for the parity, which closed at 1.2740 on the previous trading day, was 0.01%. The RSI indicator for the parity, which is below its 20-day moving average, is at 55.95, while its momentum is at 99.78. The 1.2733 level can be followed in intraday downward movements. If this level is dropped, the supports at 1.2725 and 1.2719 may become important. In possible increases, 1.2747, 1.2753 and 1.2761 will be monitored as resistance levels. Support: 1.2733 - 1.2725 Resistance: 1.2747 - 1.2753