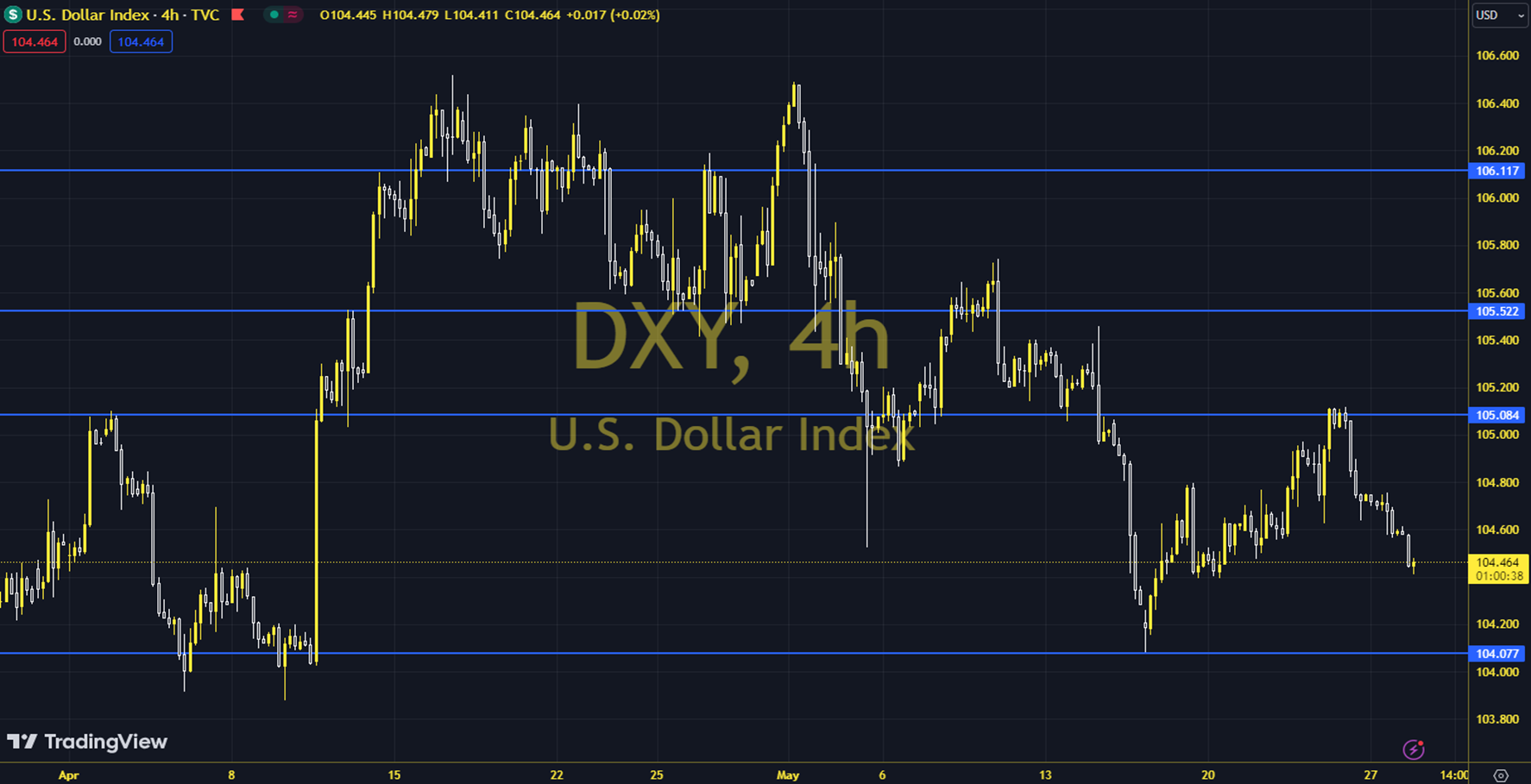

DXY

The Classic Dollar Index, which gave important messages on Monday with its negative performance in terms of ending the positive trend view, should be followed carefully in order to answer the question of whether it is serious in its intention. Although we saw a partial recovery yesterday, the related rise is not strong enough to end the general negative perception. Psychologically, 105, theoretically, 34 and 100-day averages (104.33 - 104.65 region) can now be explained as strong reference areas in order to create significant resistance and pressure for the new appearance of the index. The 103.960 level can be followed in intraday downward movements. If this level is broken, the supports at 103,730 and 103,590 may become important. In case of possible increases, the resistance levels at 104,330 and 104,650 will be monitored. Support: 103,960-104,730 Resistance: 104,330-104,650