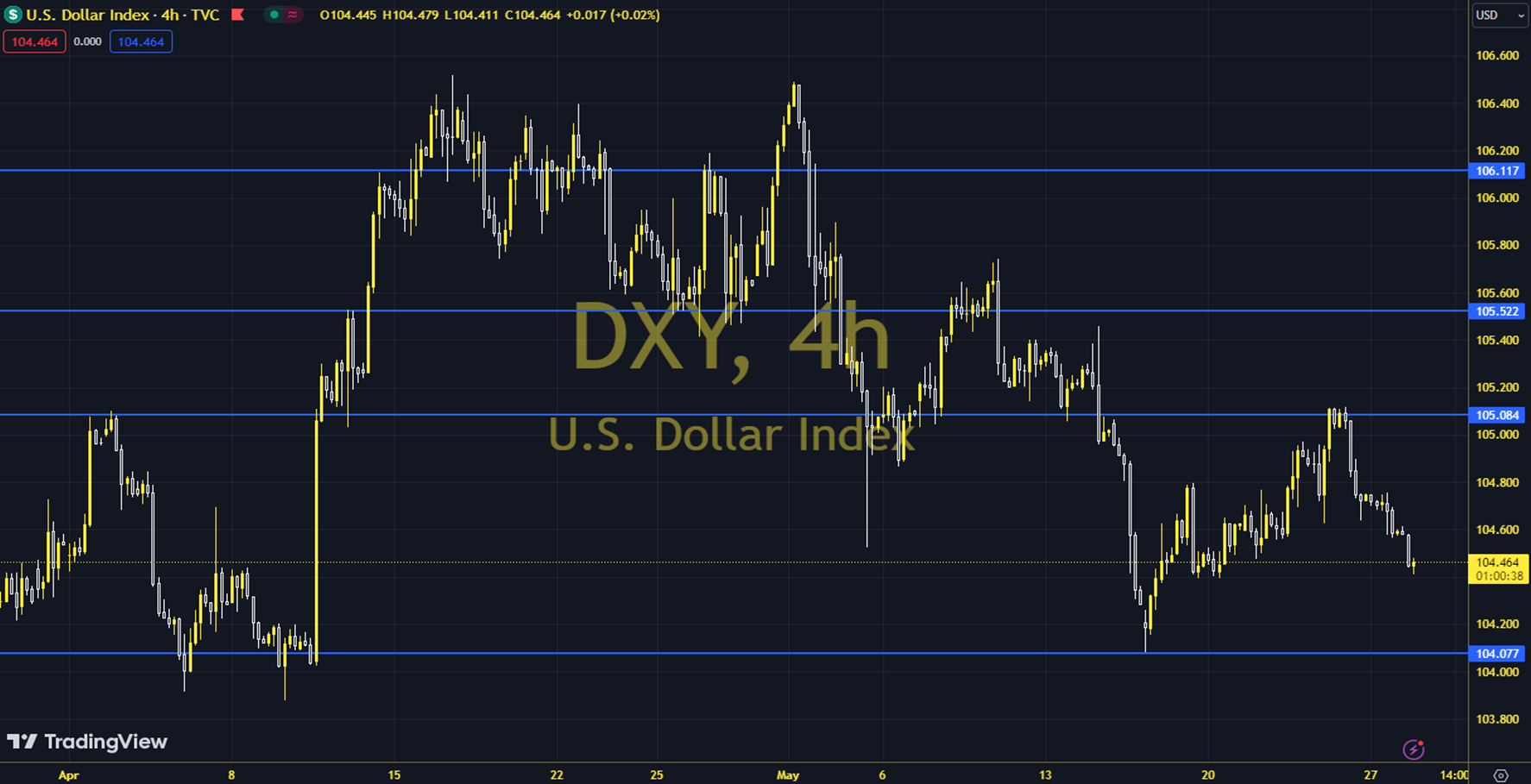

DXY

We will reach the result of the US Federal Reserve's PCE inflation indicator data today. The PCE inflation data, which will be followed closely as the most important development of the week, may create instant reactions in the Dollar index. The Classic Dollar Index is following a process that tries to exceed the upper region in the fluctuation between 105.00 - 103.90 before the data. Although the daily closing above the 34-day average supports the positive trend view, it has not been observed to be permanent above 105 yet. In this respect, today's PCE data can answer the question of whether it will confirm a positive trend above 105 or question a positive trend by approaching the 103.90 level. The 104.780 level can be followed in intraday downward movements. If this level is broken, the support levels of 104,560, 104,330 and 103,990 may become important. In case of possible increases, the resistance levels of 105,080, 105,240 and 105,570 will be monitored. Support: 104,780-104,560 Resistance: 105,080-105,240