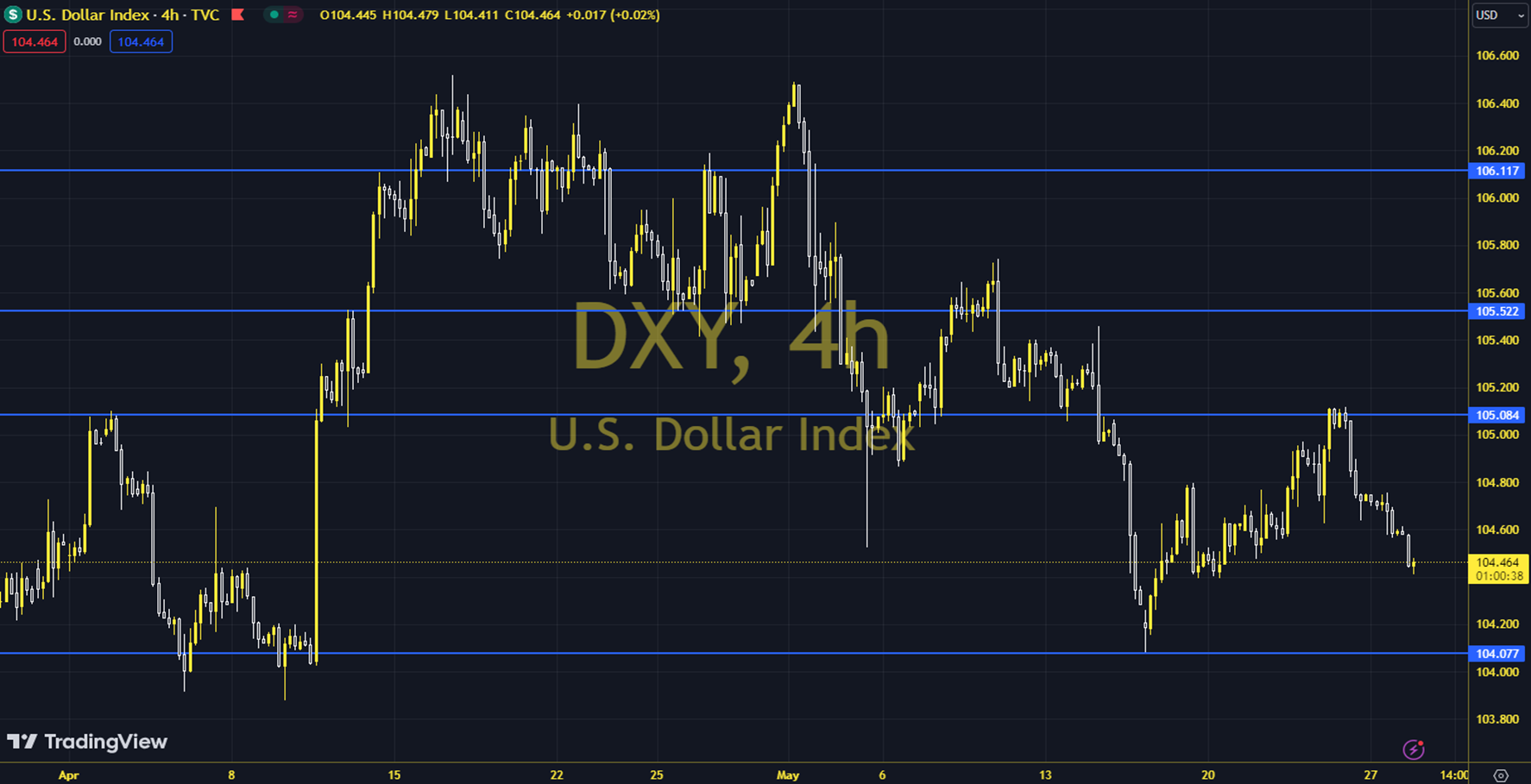

DXY

The Classic Dollar Index follows a profile that prevents the parities from taking clear steps in their short-term outlook with its fluctuations between 105.00 and 103.90. There is a possibility that the index will break out of this region with the high-level macroeconomic indicators that we will follow in the remaining days of the week. Theoretically, above 105.00 can be explained as the continuation of the positive trend towards the index, while below 103.90 can be explained as a trend change. In today's calendar, German CPI, US Richmond Manufacturing Index and FOMC Member Williams' speech can be explained as intraday developments. The 104.480 level can be followed in intraday downward movements. If this level is broken, the supports at 104,260, 103,990 and 103,790 may become important. In case of possible increases, the resistance levels at 104,880, 105,040 and 105,270 will be monitored. Support: 104,480-104,260 Resistance: 104,880-105,040