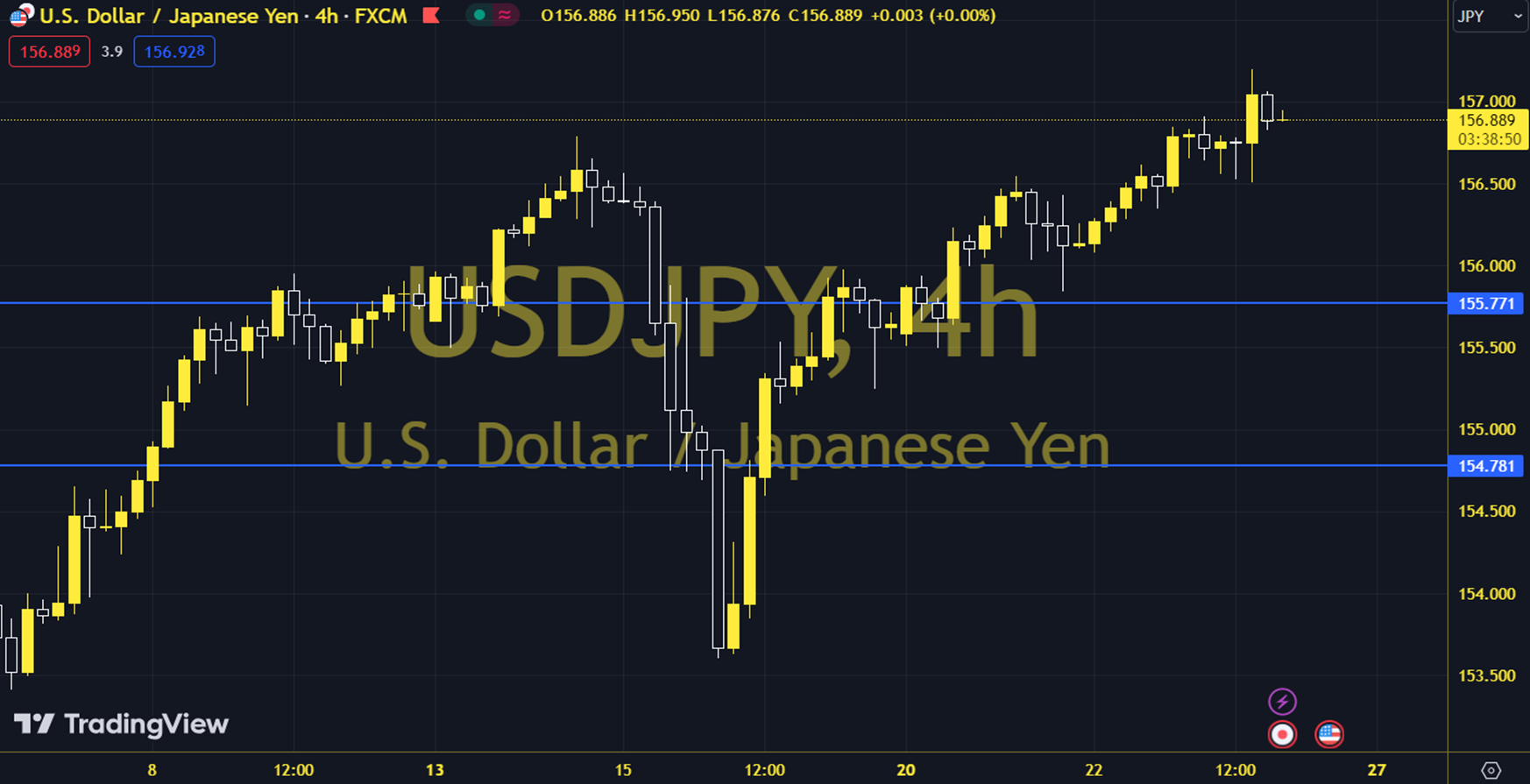

USDJPY

Despite the Bank of Japan (BoJ) announcing on Thursday that it has not changed the amount of Japanese government bonds (JGB) compared to the previous operation, the Japanese Yen (JPY) remains flat. More than a month ago, the BoJ reduced the amount of 5-10 year bonds it purchased in a planned operation. It is observed that the parity is increasing due to the appreciation of the dollar. The upward movement observed in the dollar index supports the parity upward. The daily gain for the parity, which closed at 157.09 on the previous trading day, was 0.09%. The RSI indicator for the parity, which is above its 20-day moving average, is at 62.17, while its momentum is at 101.03. The 157.04 level can be followed for intraday downward movements. If this level is broken, the supports at 156.94, 156.79 and 156.68 may become important. In case of possible increases, the resistance levels at 157.19, 157.30 and 157.45 will be monitored. Support: 156.940 – 156.790 Resistance: 157.190 – 157.300