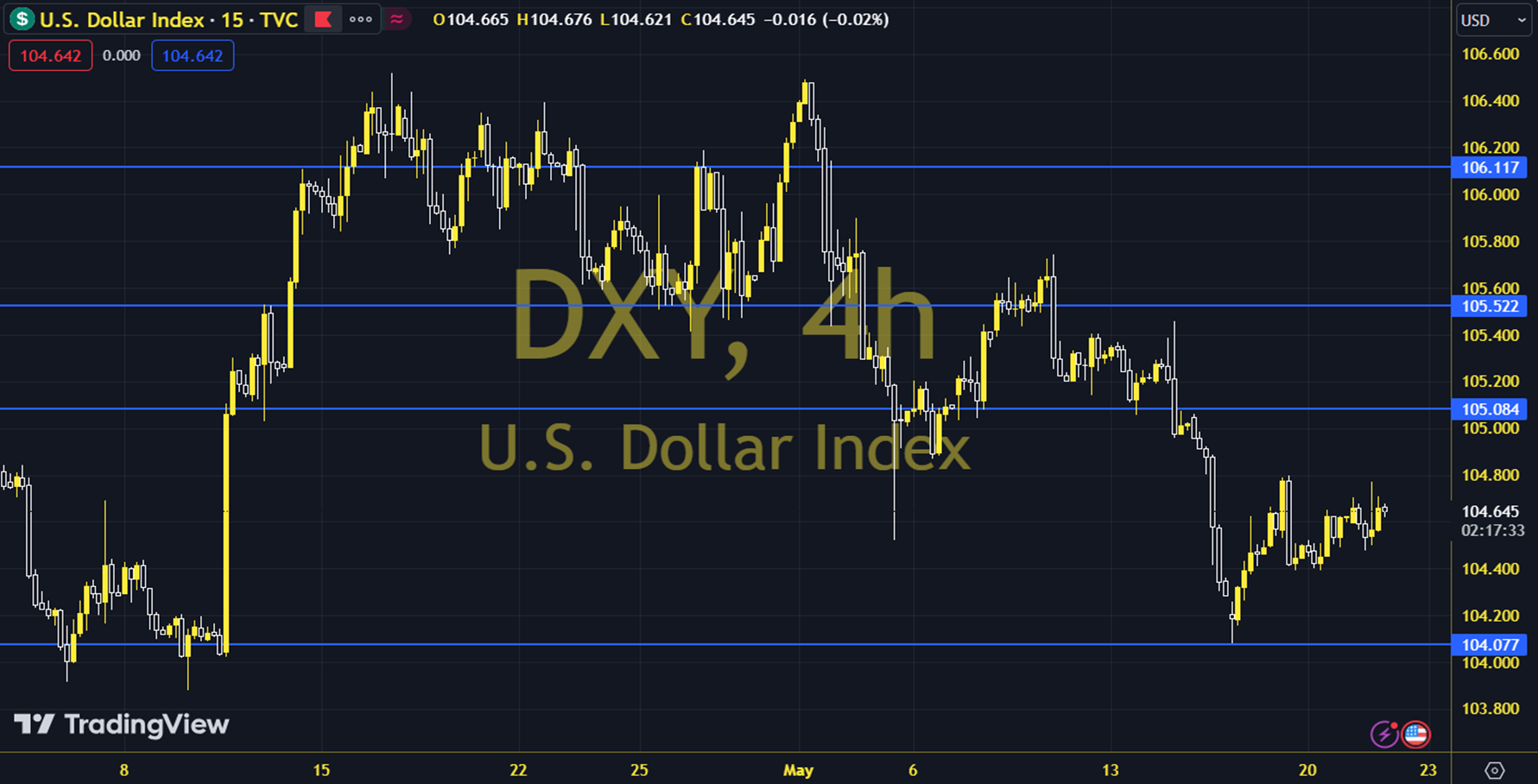

DXY

The FOMC meeting minutes, where we will access the details of the Fed meeting on May 1, will be on our radar today. The Classic Dollar Index attracted attention with its negative pricing behavior last week. The performance of the index in this process is important in a process that allows us to question whether the positive trend appearance has ended by falling below the averages we base it on (34 and 100-day EMA). The general strategy can be explained as the confirmation of the uptrend with persistence above the 34-day average (104.85), and the end of the uptrend with persistence below the trend bottom point (103.90). (Although it continues to stay above the 100-day average (104.27) in the first two trading days of the week, we have not yet seen confirmation on the upside.) The 104,600 level can be followed in intraday downward movements. If this level is broken, the supports at 104,460, 104,210 and 103,890 may become important. In case of possible increases, the resistance levels at 104,780, 104,950 and 105,170 will be monitored. Support: 104,460-104,110 Resistance: 104,780-104,950