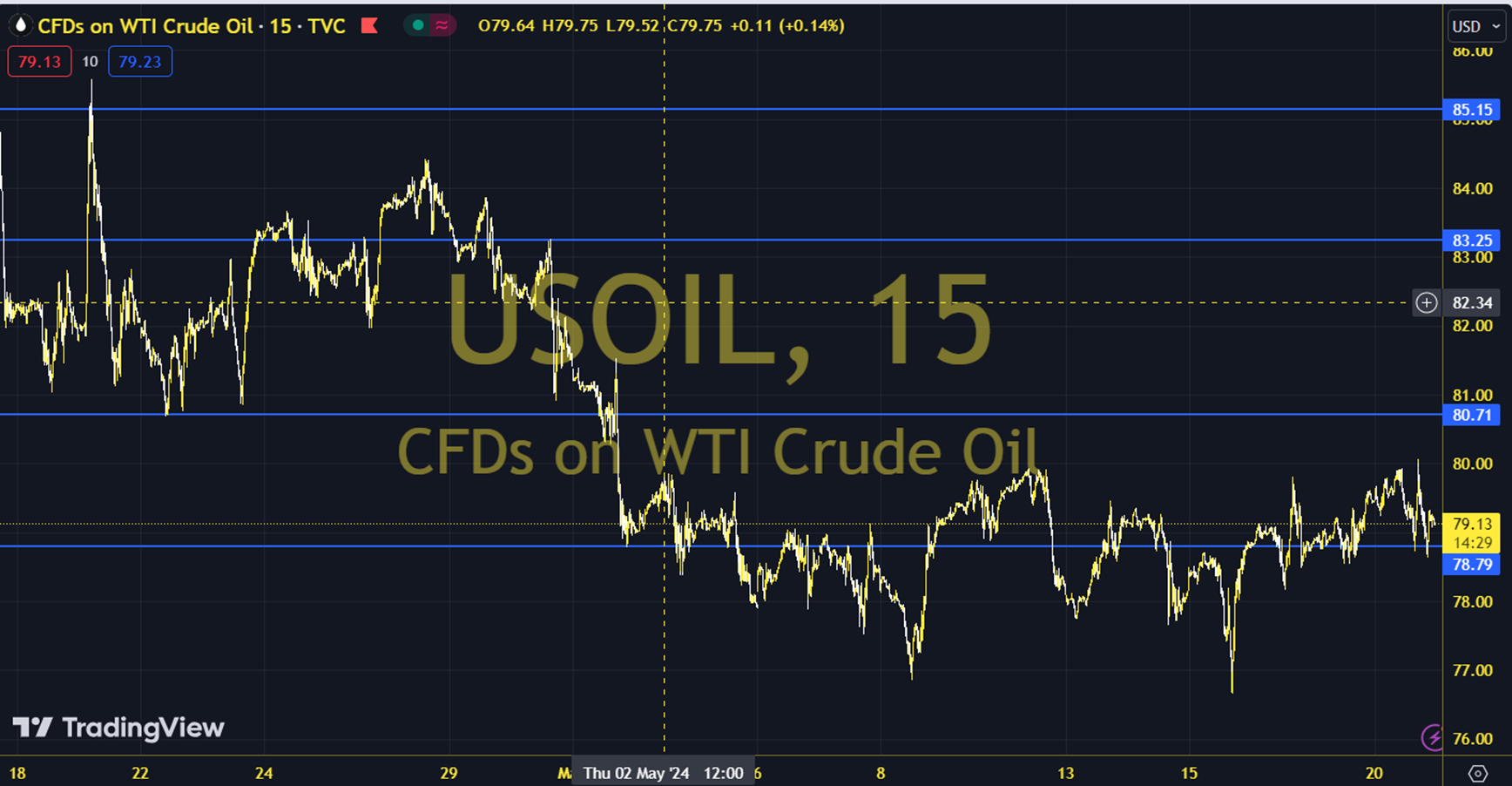

WTIUSD

Despite headlines that raised geopolitical risk perceptions over the weekend, oil futures contracts showed a downward trend. A weak demand outlook is making its impact felt ahead of the OPEC meeting to be held in early June. The course of European and US stock markets, Fed officials' speeches and the stock figures to be announced by the American Petroleum Institute can be followed during the day. The upward effort has once again been blocked by the 79.50 - 80.00 resistance. Therefore, for now, we will be following the effectiveness of this resistance instead of following the average. As long as pricing remains at and below the 79.50 - 80.00 resistance during the day, a downward view may be at the forefront. In possible declines, 78.50 and 78.00 levels can be targeted. In recoveries, as long as the 79.50 - 80.00 resistance remains current, new downward potential may occur. Therefore, for the continuation of the upward desire, it may be necessary to see the course above 80.00 and 4-hour closings. In this case, 80.50 and 81.00 levels may come to the agenda. Support: 78.00 – 77.50 Resistance: 79.50 – 80.00