WTIUSD

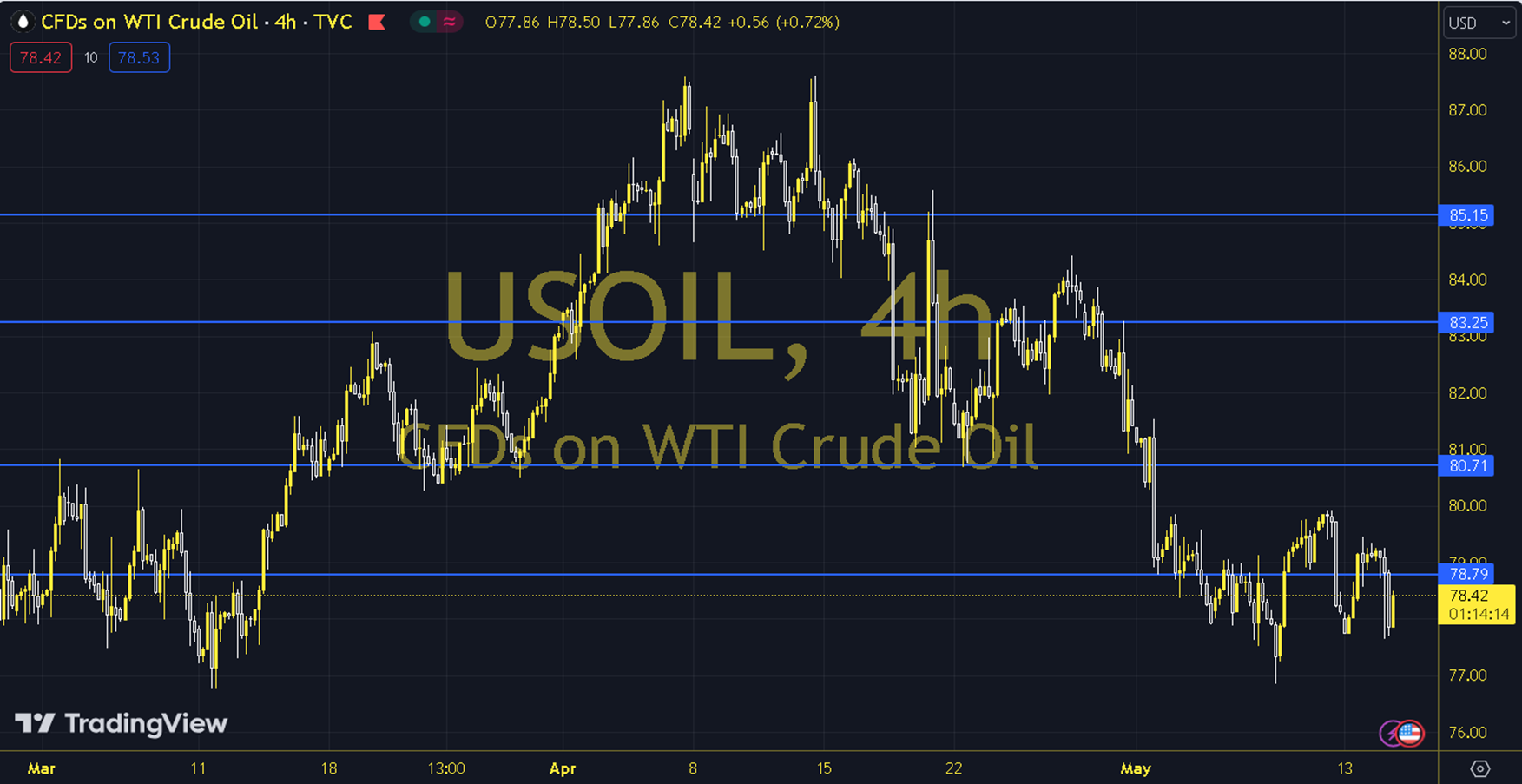

While oil futures recovered some of the losses incurred yesterday, the American Petroleum Institute's announcement of a 3.1 million barrel decrease in stocks supported this recovery. The course of European and US stock markets, US inflation data and stock figures to be announced by the US Energy Information Administration can be followed during the day. As long as the pricing remains at and below the 78.50 - 79.00 resistance supported by the 50-period exponential moving averages during the day, a downward outlook may be at the forefront. In possible declines, 77.50 and 77.00 levels can be targeted. In recoveries, as long as the 78.50 - 79.00 resistance remains current, new downward potential may occur. Therefore, it may be necessary to see a course above 79.00 and 4-hour closings for the continuation of the upward desire. In this case, 79.50 and 80.00 levels may come to the agenda. Support: 78.00 - 77.50 Resistance: 79.50 - 80.00