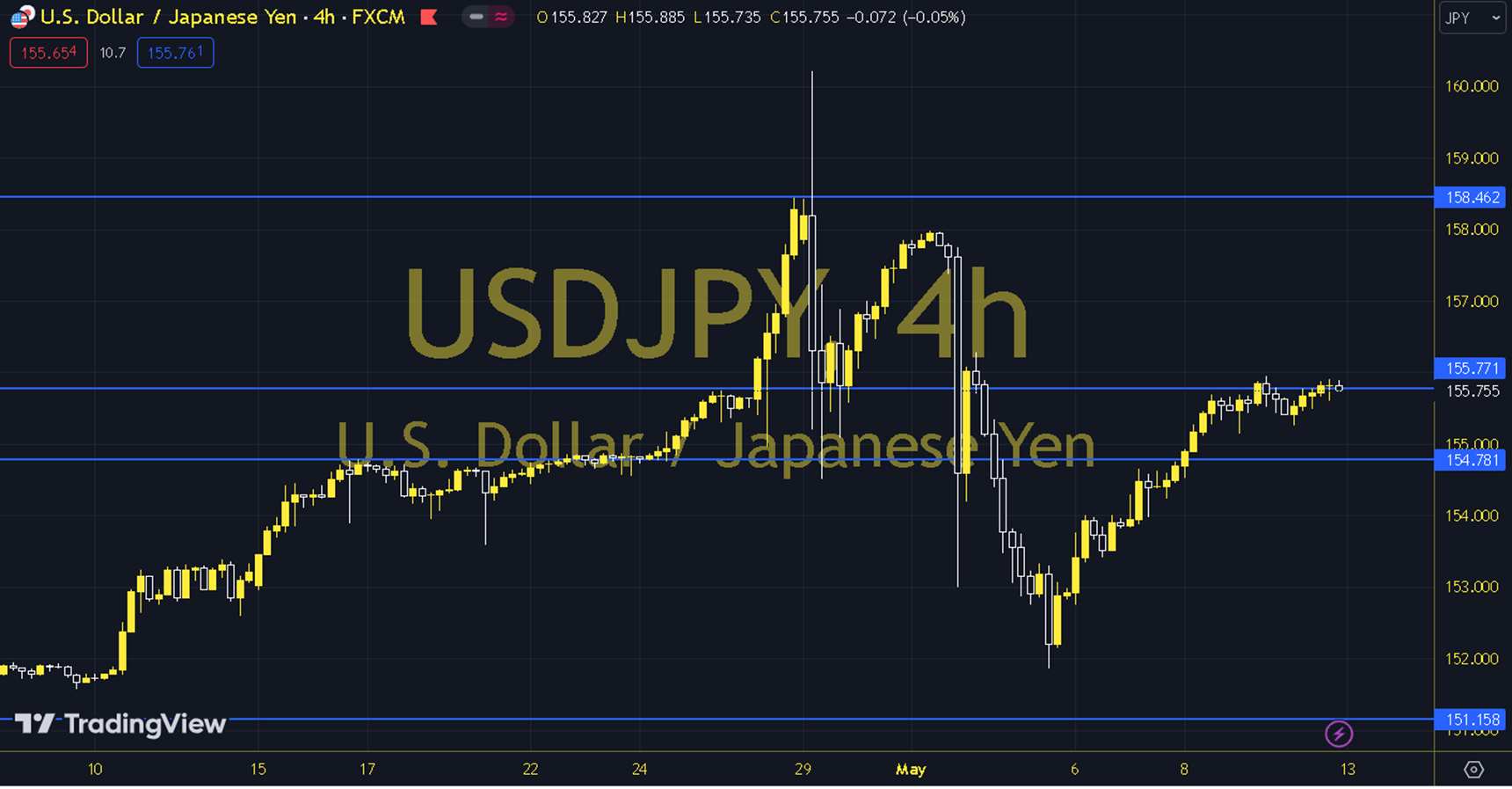

USDJPY

For the Japanese Yen (JPY), Katsunobu Kato, a former cabinet secretary of Japan, said today that conditions are beginning to emerge for the central bank to normalize monetary policy in Japan and underlined the increasing political support for further interest rate hikes. This shows us that volatility will continue for a while. It is observed that the parity is increasing due to the appreciation of the dollar. The upward movement observed in the dollar index supports the parity upwards. The daily gain for the parity, which closed at 155.79 on the previous trading day, was 0.03%. The RSI indicator for the parity, which is above its 20-day moving average, is at 58.34, while its momentum is at 100.11. The 155.77 level can be followed for intraday downward movements. If this level is broken, supports at 155.59, 155.38 and 155.20 may become important. In case of possible increases, resistance levels at 155.98, 156.16 and 156.37 will be monitored. Support: 155.590 – 155.380 Resistance: 155.980 – 156.160