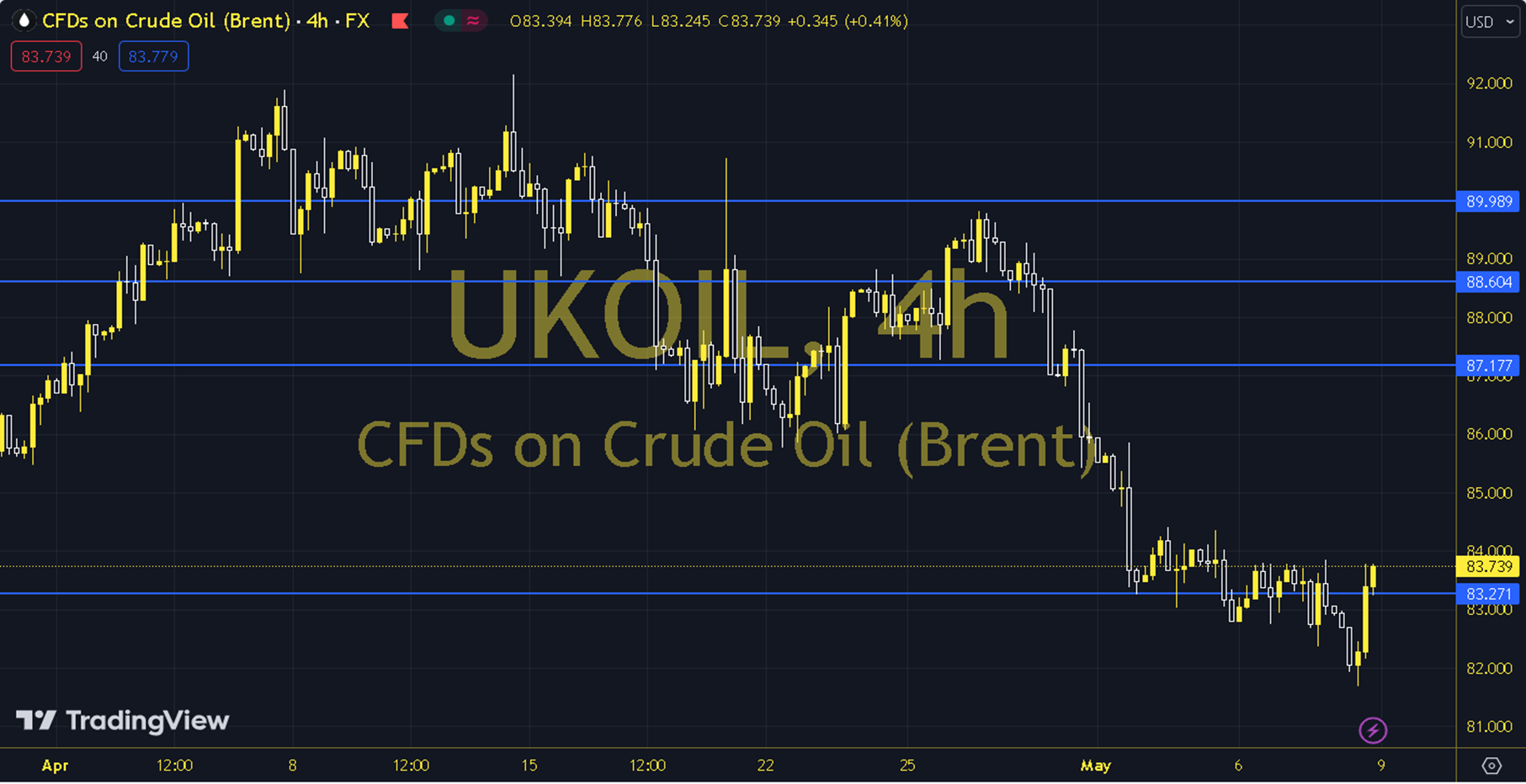

BRENT

The oil futures contract started to recover after the US Energy Information Administration announced a 1.4 million barrel decrease in stocks, contributing to the testing of the highest levels since May 3 in the Asian session. While the Middle East developments are still being closely monitored, the course of European and US stock markets can be followed during the day. It is seen that there is a general downtrend. Brent oil saw a high of 83.59 and a low of 81.56 on the previous trading day. Brent oil, which followed a buying trend on the last trading day, gained 0.76% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 38.64, while its momentum is at 96.69. The 82.89 level can be followed in intraday downward movements. If this level is broken, the supports of 82.19, 80.86 and 80.16 may become important. In possible increases, 84.23, 84.93 and 86.26 will be monitored as resistance levels. Support: 82.89 – 82.19 Resistance: 84.23 – 84.93