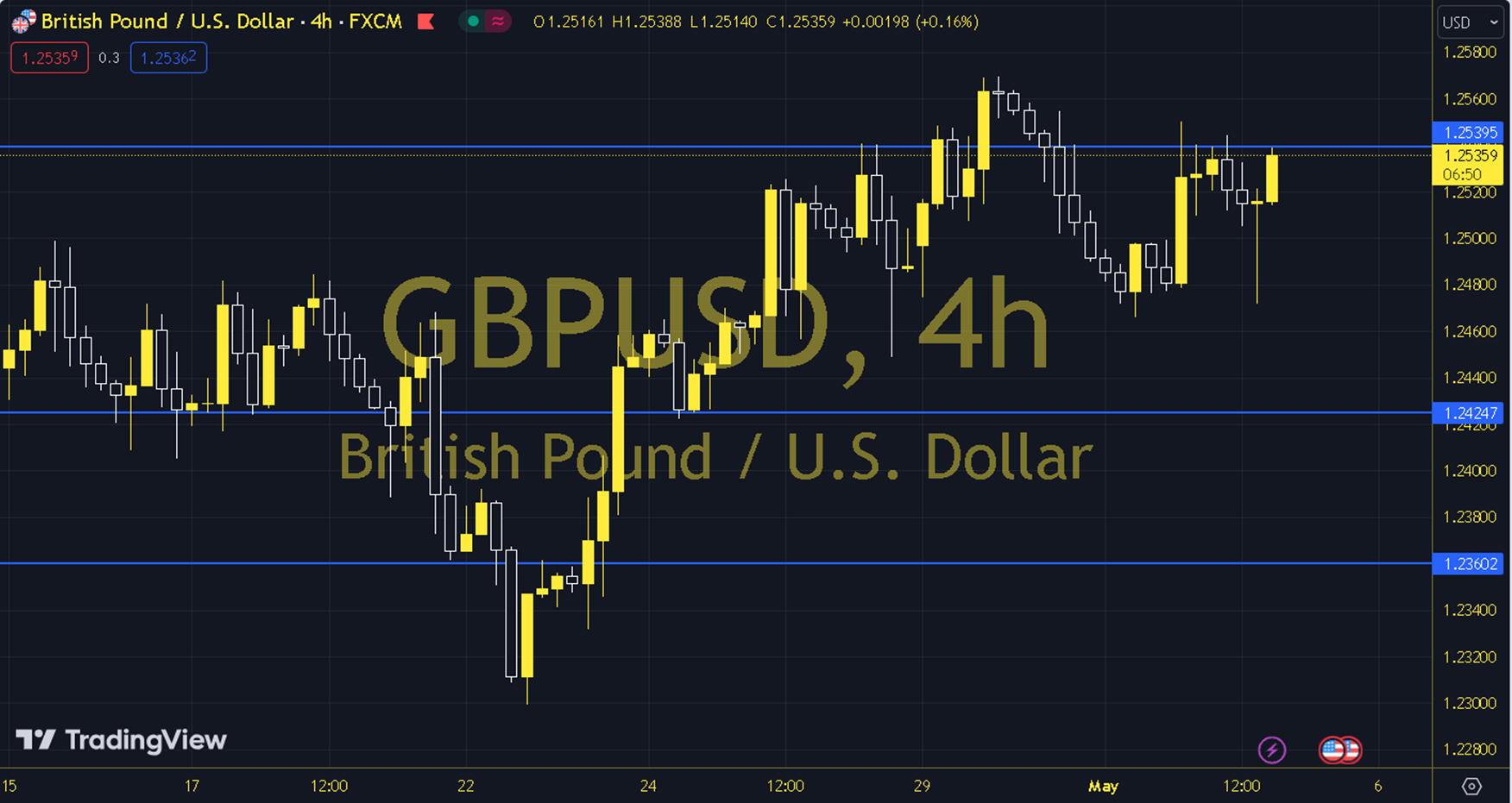

GBPUSD

On the agenda of the new week, after the Fed meeting on May 1, FOMC members will take the stage for guidance. In addition to the BoE and FOMC, UK Growth and Industrial Production, Germany and Eurozone Services PMI and US Unemployment Claims data can also be explained as developments to be followed. When we focus on today, we will reach the results of the purchasing managers index, or PMI data, for the services sector from Germany and the Eurozone. The daily gain for the parity, which closed at 1.2547 on the previous trading day, was 0.00%. The RSI indicator for the parity, which is below its 20-day moving average, is at 51.37, while its momentum is at 100.89. The 1.2547 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 1.2557, 1.2567 and 1.2576 may become important. In possible pullbacks, 1.2538, 1.2528 and 1.2519 will be followed as support levels. Support: 1.2528 – 1.2519 Resistance: 1.2557 – 1.2576