DAXEUR

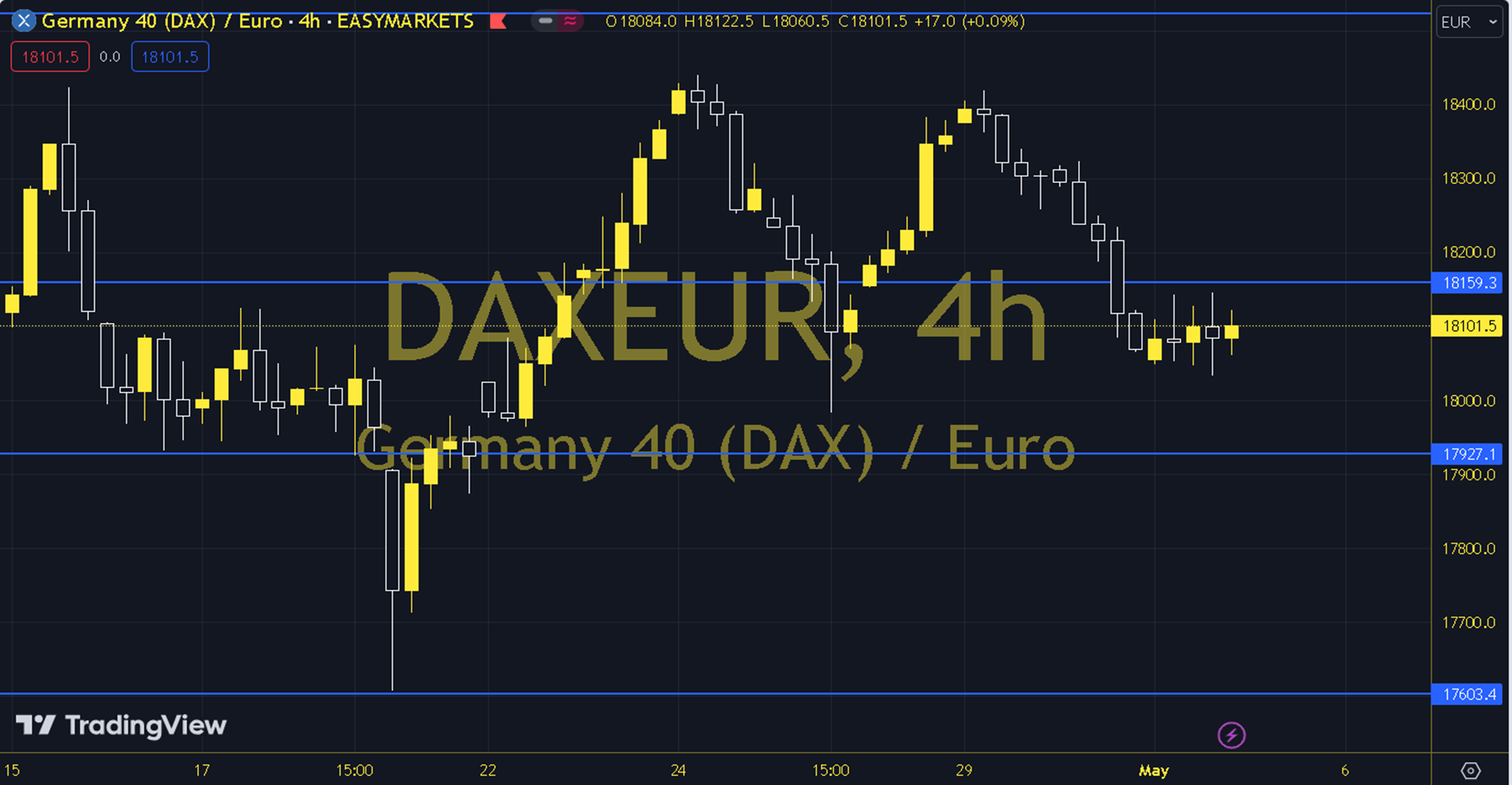

The day before, European stock markets were selling while the DAXEUR index closed 0.20% negative. The index, which started the day negatively before the US employment data to be announced today, continues its suppressed appearance below the 20 and 89-period exponential moving average. When we examine the short-term pricing of the DAXEUR index technically, we are following the 17900 - 18000 region. As long as it moves below the relevant region, negative expectations are at the forefront. In the continuation of the pullbacks, the 17800 - 17700 levels can be followed as support. In possible recoveries, the 18100 - 18200 levels can be targeted as long as the 89-period exponential moving average (18000) works as support. In the possible suppression below the 18200 level, which worked as resistance in previous pricing, sags towards the 17900 support can be observed. Support: 17800 – 17700 Resistance: 18100 – 18200