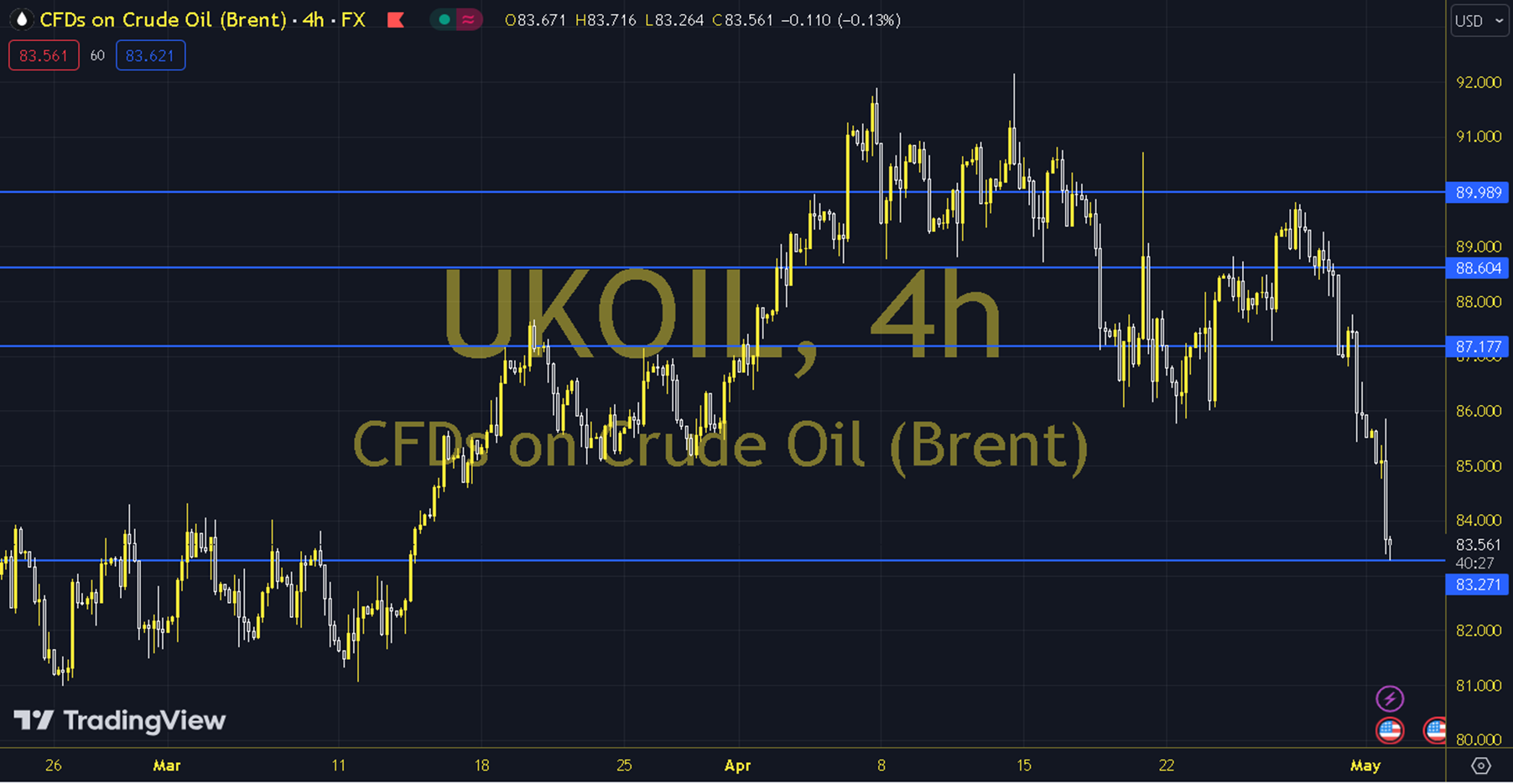

BRENT

Crude oil inventories in the US increased by 7.3 million barrels in the week ending April 26. The sharpest weekly increase since February highlighted concerns about weak demand, putting pressure on oil futures. In the Asian session, a very small portion of these losses were recovered. Speculation that progress had been made in the hostage swap talks between Israel and Hamas in recent days had also put pressure on them. The course of European and US stock markets can be followed during the day. Brent oil saw a high of 85.76 and a low of 83.19 on the previous trading day. Brent oil, which followed a selling trend on the last trading day, lost 2.86% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 34.18, while its momentum is at 92.92. The 84.13 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 85.08, 86.71 and 87.66 may become important. In case of possible pullbacks, 82.50, 81.56 and 79.93 will be monitored as support levels. Support: 82.50 – 81.56 Resistance: 85.08 – 86.71