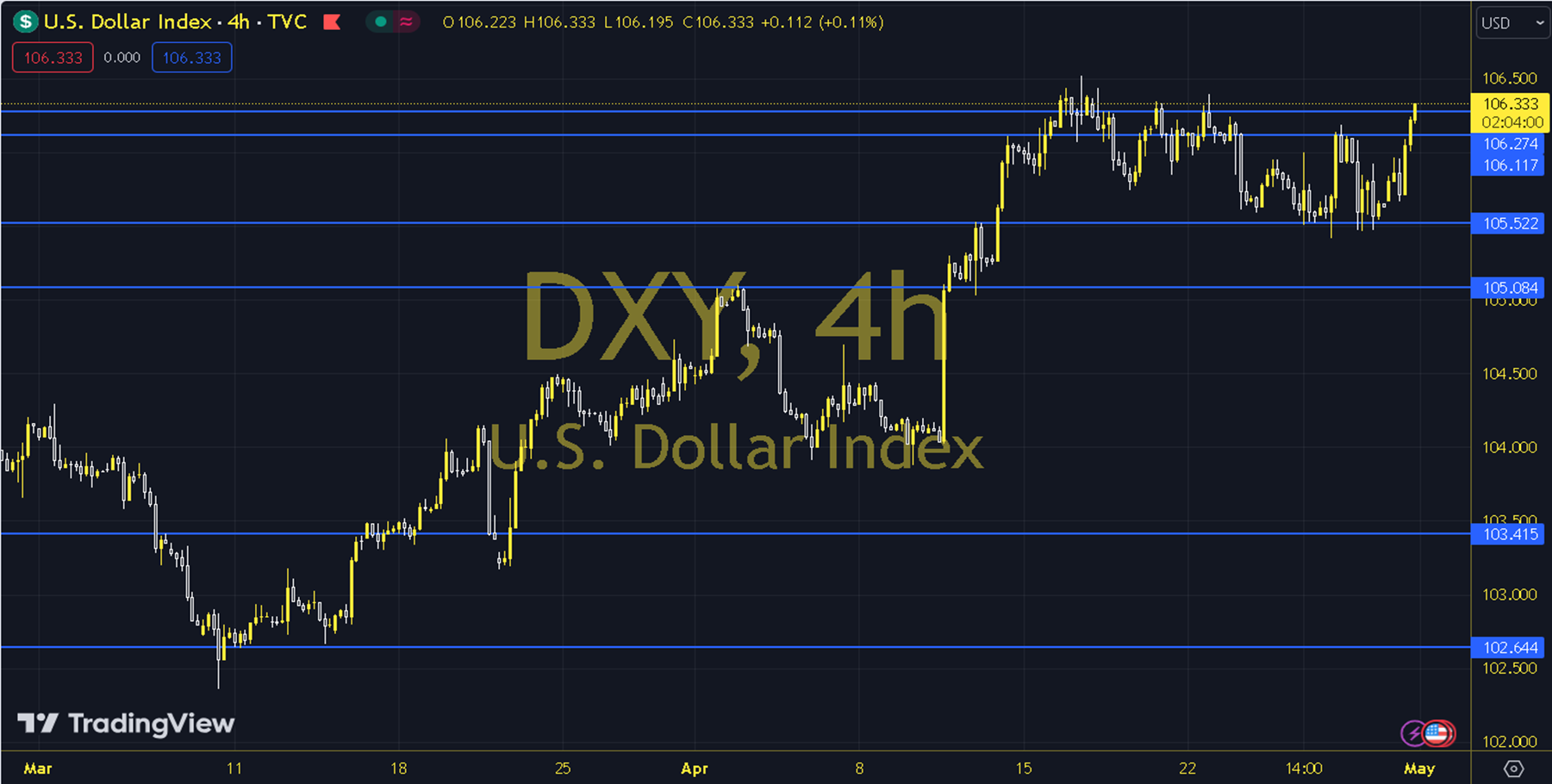

DXY

We are on the most important day of the week. We will examine the decisions of the Federal Open Market Committee (FOMC) and the speech of Fed Chairman Powell. We will follow both the statement and the chairman's guidance in answering the question of how much change the rigidity in inflation will create in the bank's current expectations before the economic projections in June. Before the critical Fed, the Classic Dollar Index keeps the expectation of reaching the 107 level tested in October 2023 with optimism on the 34 and 100-day averages (104.14 - 104.94 region). The whole week should be followed carefully to answer the question of whether the attitude of the index will be a reaction sale or a positive trend rally when it reaches / approaches the 107 level. Intraday 106,050 and 105,800 support and 106,610 and 106,940 resistance points stand out. Support: 106,050-105,800 Resistance: 106,610-106,940