BRENT

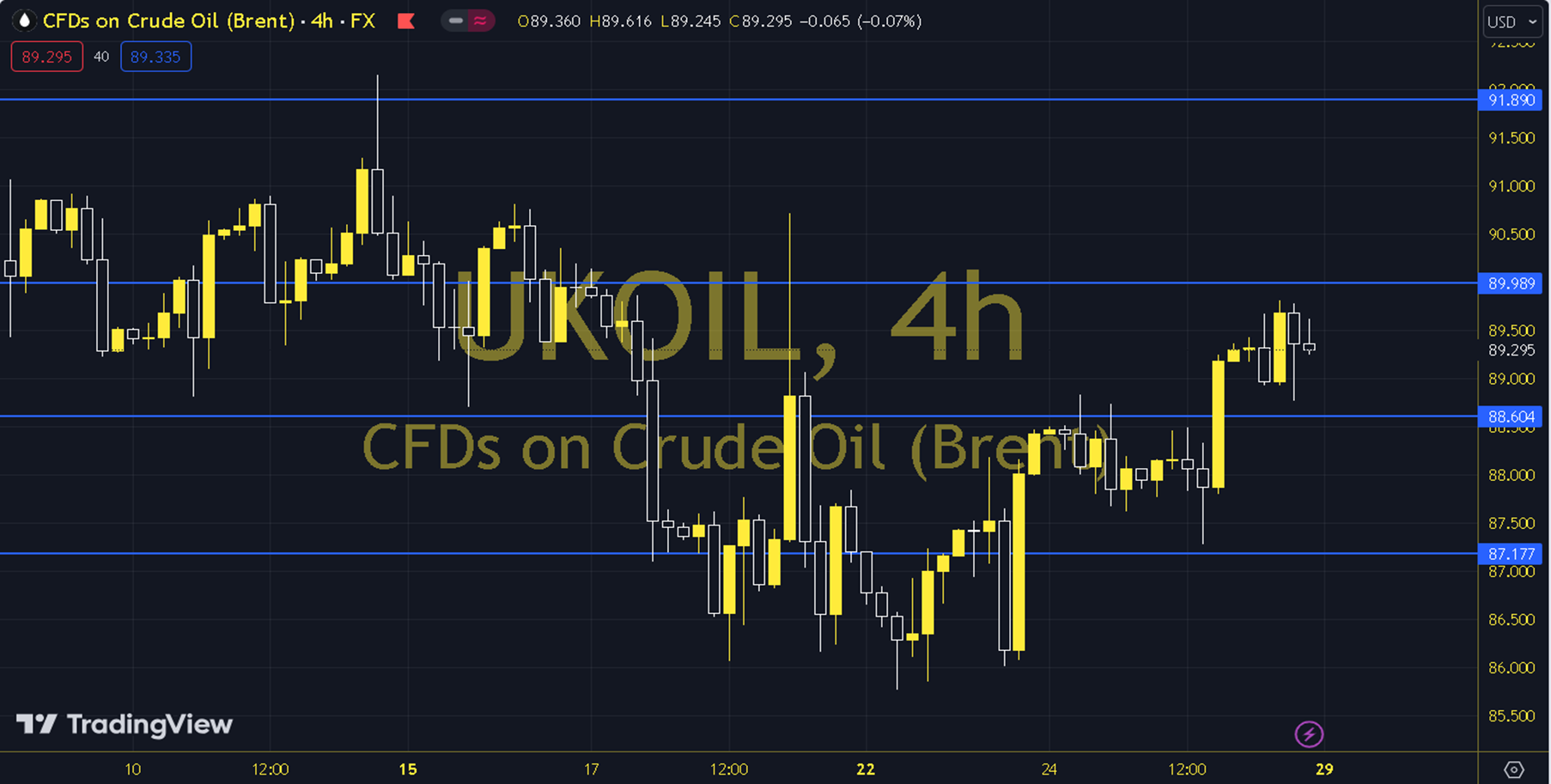

Oil prices have started to show recovery efforts, especially since the middle of the week we left behind. The US Energy Information Administration's announcement of a 6.4 million barrel decrease in stocks was effective in this. There will be an intense data flow in the US next week as well as the Fed's monetary policy statement. On the other hand, we will be following the production - stock figures as every week. It is seen that there is a general downward trend. Brent oil saw a high of 88.59 and a low of 87.60 on the previous trading day. Brent oil, which followed a buying trend on the last trading day, gained 0.08% daily. The RSI indicator for the commodity, which is above its 20-day moving average, is at 54.73, while its momentum is at 97.79. The 88.08 level can be followed in intraday upward movements. If this level is exceeded, the 88.56, 89.08 and 89.56 resistances may become important. In case of possible pullbacks, 87.57, 87.08 and 86.57 will be monitored as support levels. Support: 87.57 – 87.08 Resistance: 89.08 – 89.56