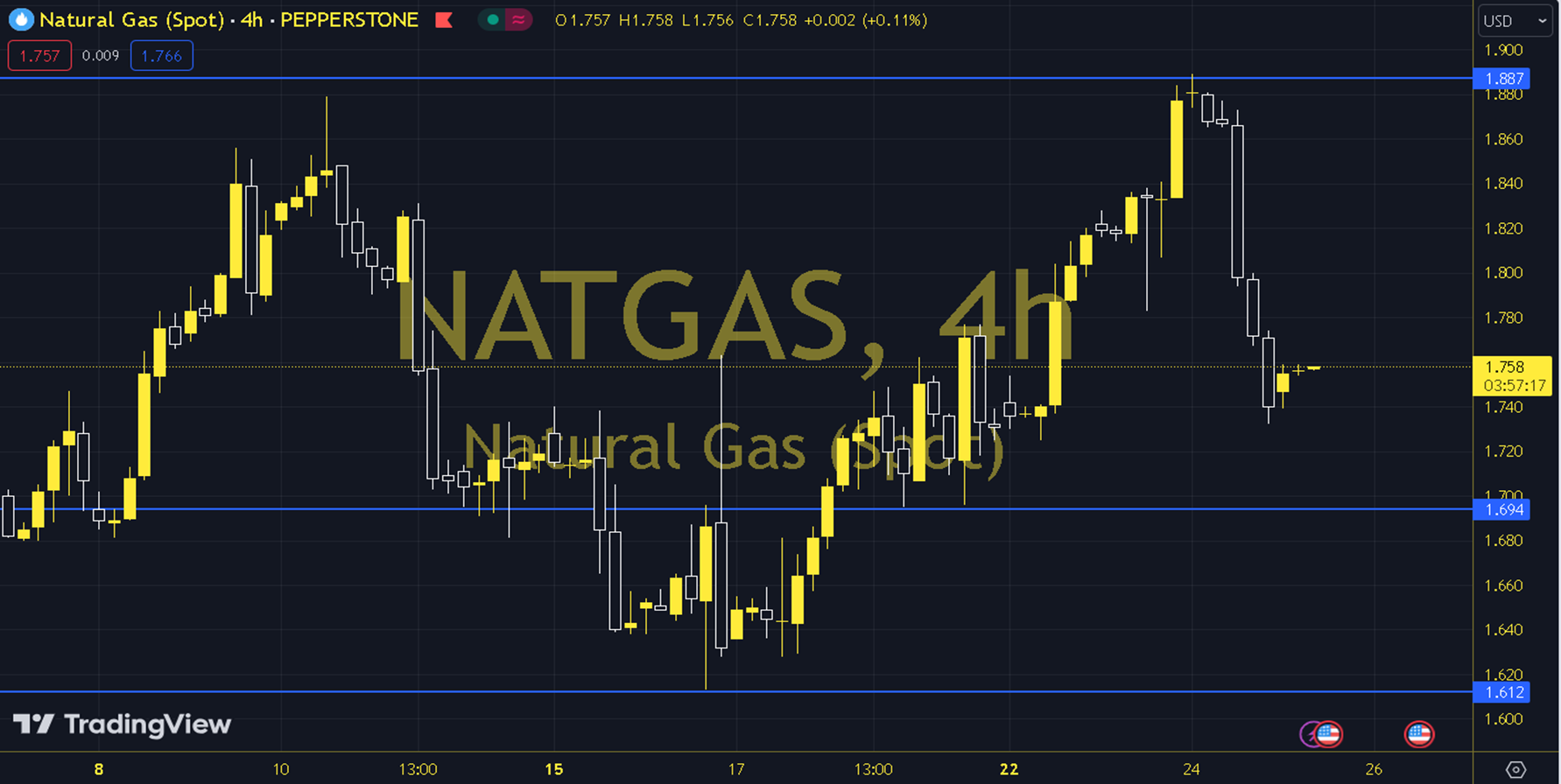

NGAS

The natural gas futures contract experienced a significant loss in the middle of the week due to the expectation that heating demand would decline ahead of today's stock figures. On the other hand, the relatively weak flow to LNG facilities also supported this situation. The course of the US stock markets can be followed with stock figures during the day. As long as it moves within the 1.70 - 1.74 region, the decision-making phase scenario may be valid. 4-hour closings outside the region can be followed for direction. If the increases continue and persistence is seen above the 1.74 resistance, the 1.79 and 1.82 levels may be encountered. If possible declines occur and permanent pricing occurs below the 1.70 level, the 1.66 and 1.62 levels may come to the agenda. Support: 1.74 - 1.79 Resistance: 1.66 - 1.62