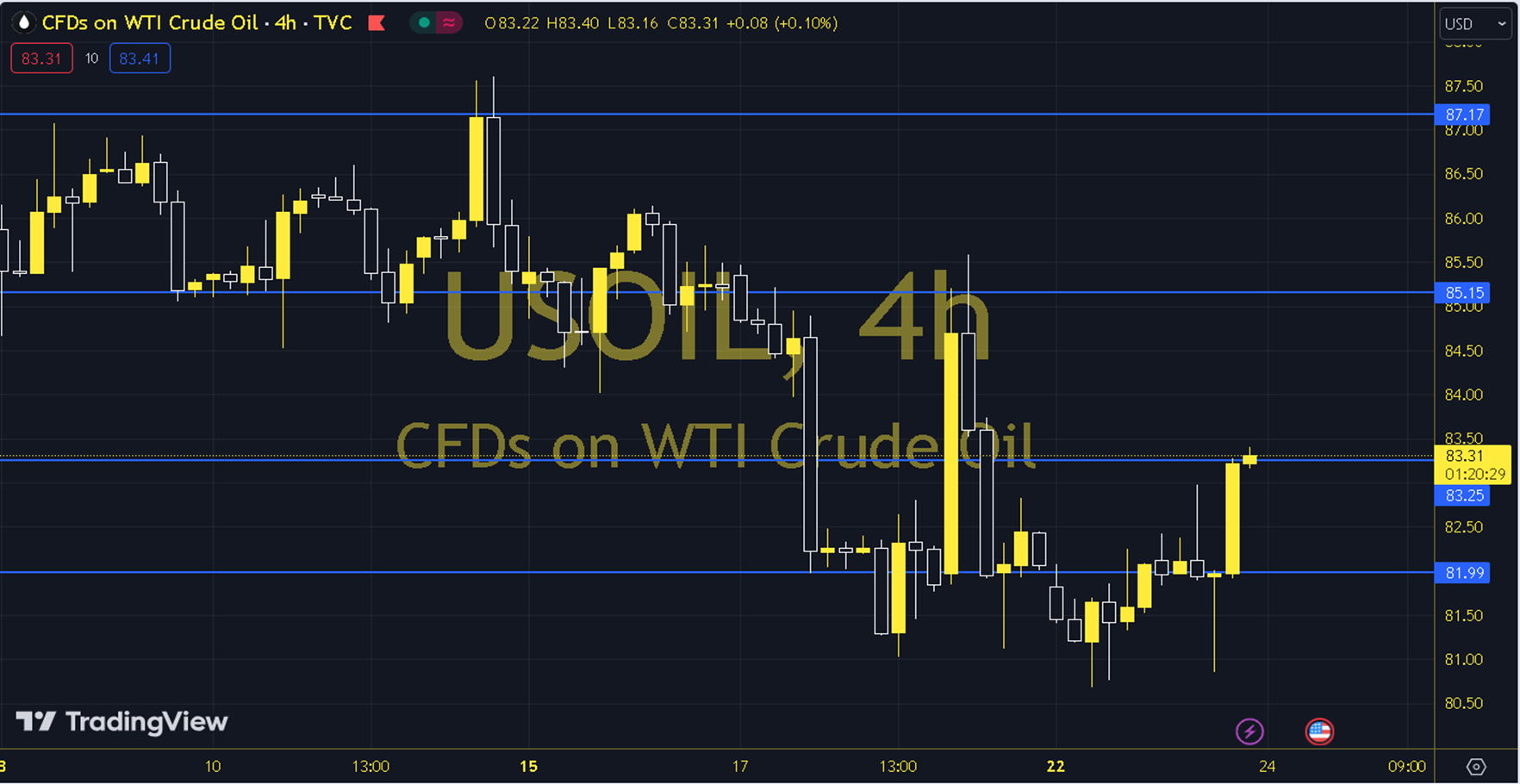

WTIUSD

It is seen that oil futures contracts increased their gains since yesterday. In this, in addition to the announcement of a 3.2 million barrel decrease in stocks by the American Petroleum Institute, it is also seen that the decision to impose sanctions on Iran is being weighed. Middle East tensions and OPEC+ cuts are other factors supporting the increase in a broader sense. The course of European and US stock markets and the stock figures to be announced by the US Energy Information Administration can be followed during the day. As long as the pricing remains at and above the 82.50 - 83.00 support in the upcoming period, an upward trend may be at the forefront. On the WTI side, a downward trend parallel to Brent oil prevails. WTI oil saw a high of 83.27 and a low of 80.77 on the previous trading day. The 82.41 level can be followed in intraday downward movements. In case of falling below this level, the supports of 81.54, 79.90 and 79.04 may become important. In possible increases, 84.05, 84.92 and 86.56 will be monitored as resistance levels. Support: 81.54 - 79.90 Resistance: 84.05 - 84.92