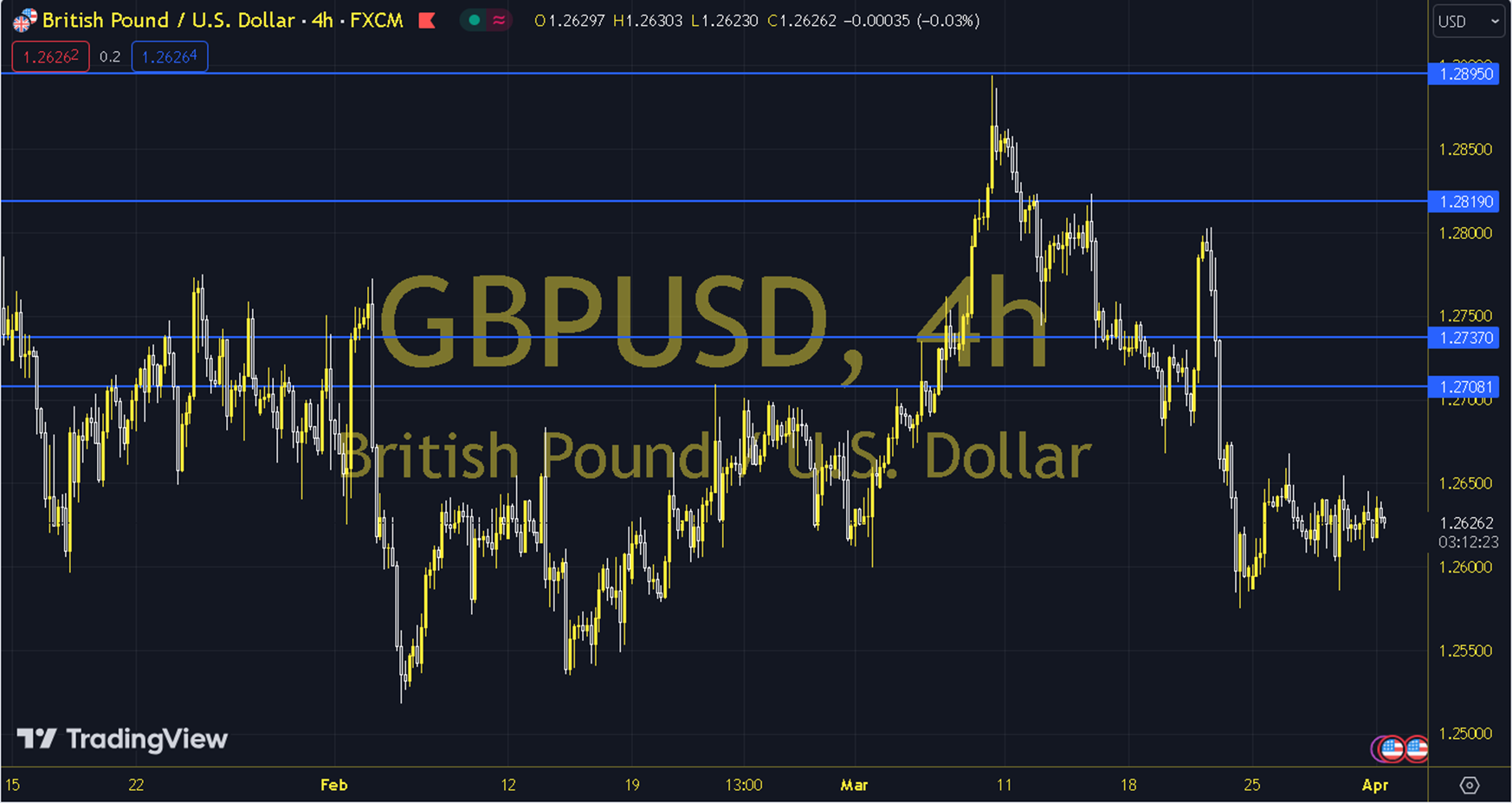

GBPUSD

The upward movement observed in the Dollar index for GBPUSD is pressuring the parity downward. In the new week that we started the second quarter of the year, we will examine the US-intensive data flow within the basic macro framework. Our main focus as calendar data is the Nonfarm Payrolls, Unemployment Rate and Average Hourly Earnings data on April 5. The daily loss for the parity, which closed at 1.2630 on the previous trading day, was 0.01%. The RSI indicator for the parity, which is below its 20-day moving average, is at 43.15, while its momentum is at 99.03. The 1.2633 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 1.2641, 1.2652 and 1.2660 may become important. In possible pullbacks, 1.2622, 1.2614 and 1.2594 will be monitored as support levels. Support: 1.2614 – 1.2594 Resistance: 1.2641 – 1.2652