BRENT

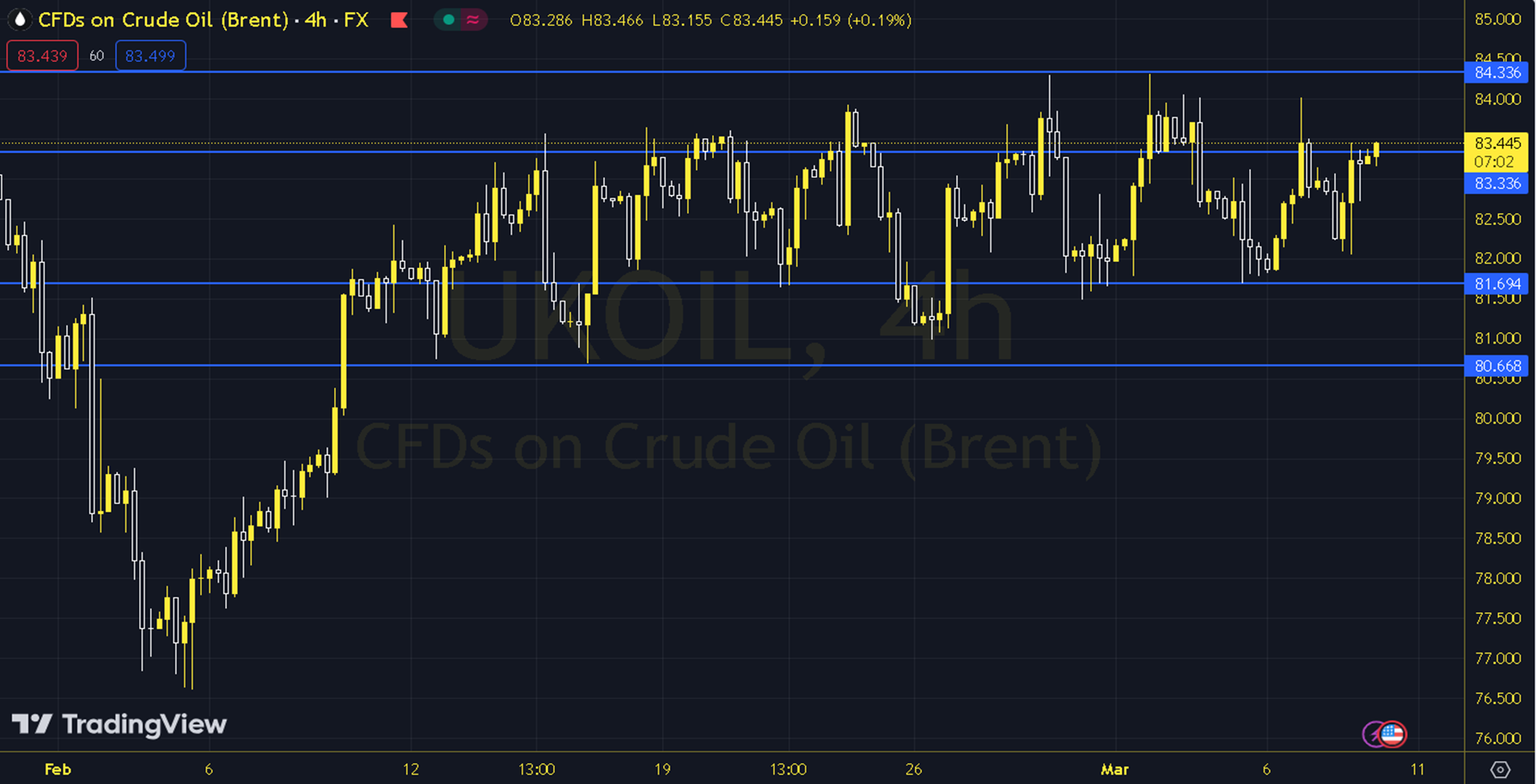

Oil futures contracts showed an upward trend due to the disruption in the Keystone pipeline that provides oil flow from Canada to the US. During the week, OPEC+'s decision to extend the production cut and the high course of geopolitical risks supported oil prices. The course of European and US stock markets can be followed during the day. In the upcoming process, as long as the prices remain at and above the 82.50 - 83.00 support, an upward view may be at the forefront. In possible increases, 84.00 and 84.50 levels can be targeted. In possible decreases, as long as it is limited by the 82.50 - 83.00 support, new upside potential may occur. Therefore, it may be necessary to see the course below 82.50 and 4-hour closings for the continuation of the downward desire. In this case, the 82.00 and 81.50 levels may come to the agenda. Support: 83.00 - 82.50 Resistance: 84.00 - 84.50