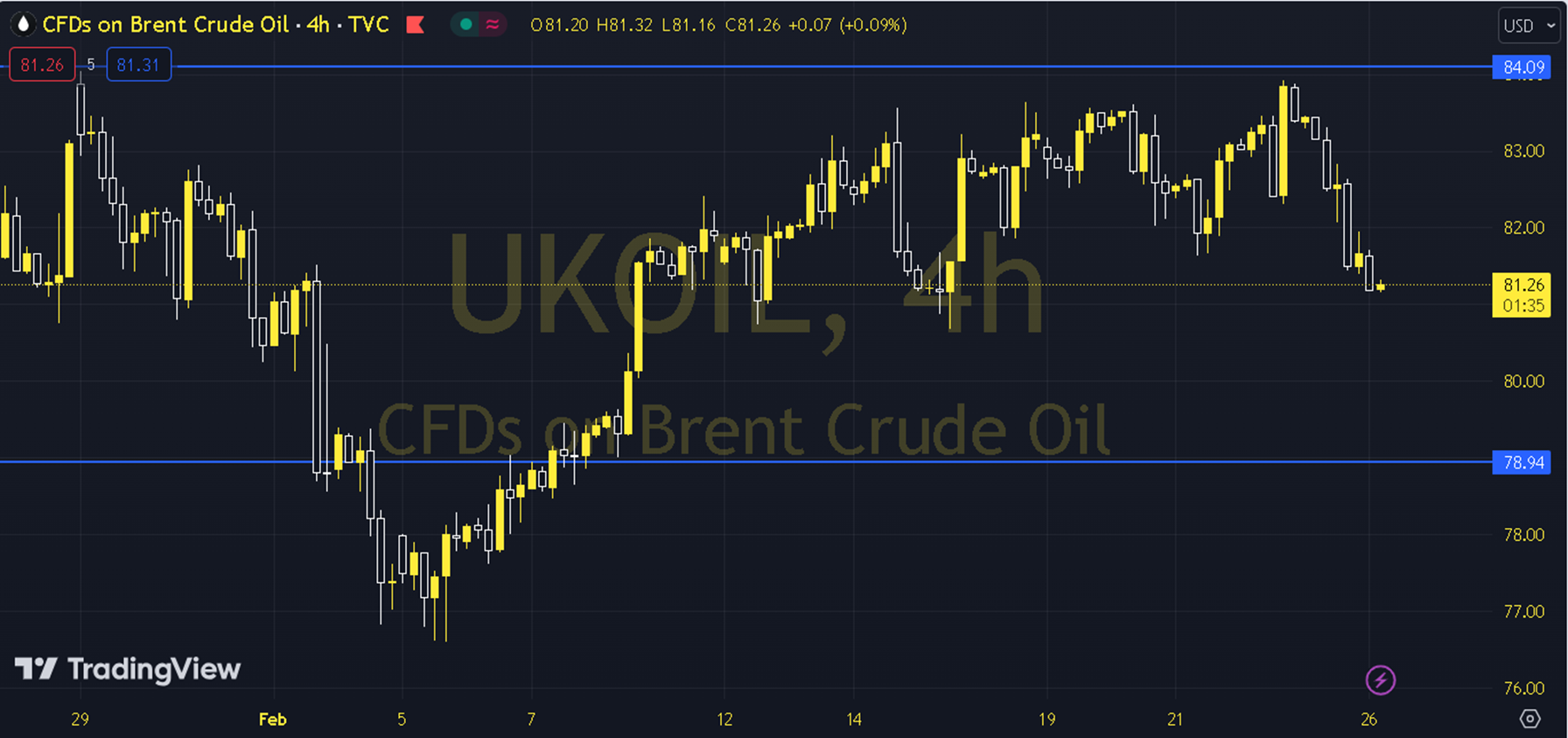

BRENT

Oil prices started the week with losses due to concerns about weak demand. Important data will be monitored in the US throughout the week. Inflation is at the top of the list. In addition, we will continue to follow the production and stock figures in the US and the Middle East agenda. In the upcoming process, as long as the prices remain at and below the 81.00 - 81.50 resistance, a downward outlook may be at the forefront. In possible declines, the 80.00 and 79.50 levels may be targeted. In possible recoveries, as long as the 81.00 - 81.50 resistance remains current, a new downward potential may occur. Therefore, it may be necessary to see the course above 81.50 and hourly closings for the continuation of the upward demand. In this case, the 82.00 and 82.50 levels may be on the agenda. In the upcoming process, as long as the prices remain at and below the 81.00 - 81.50 resistance, a downward outlook may be at the forefront. Support: 79.50 Resistance: 82.50