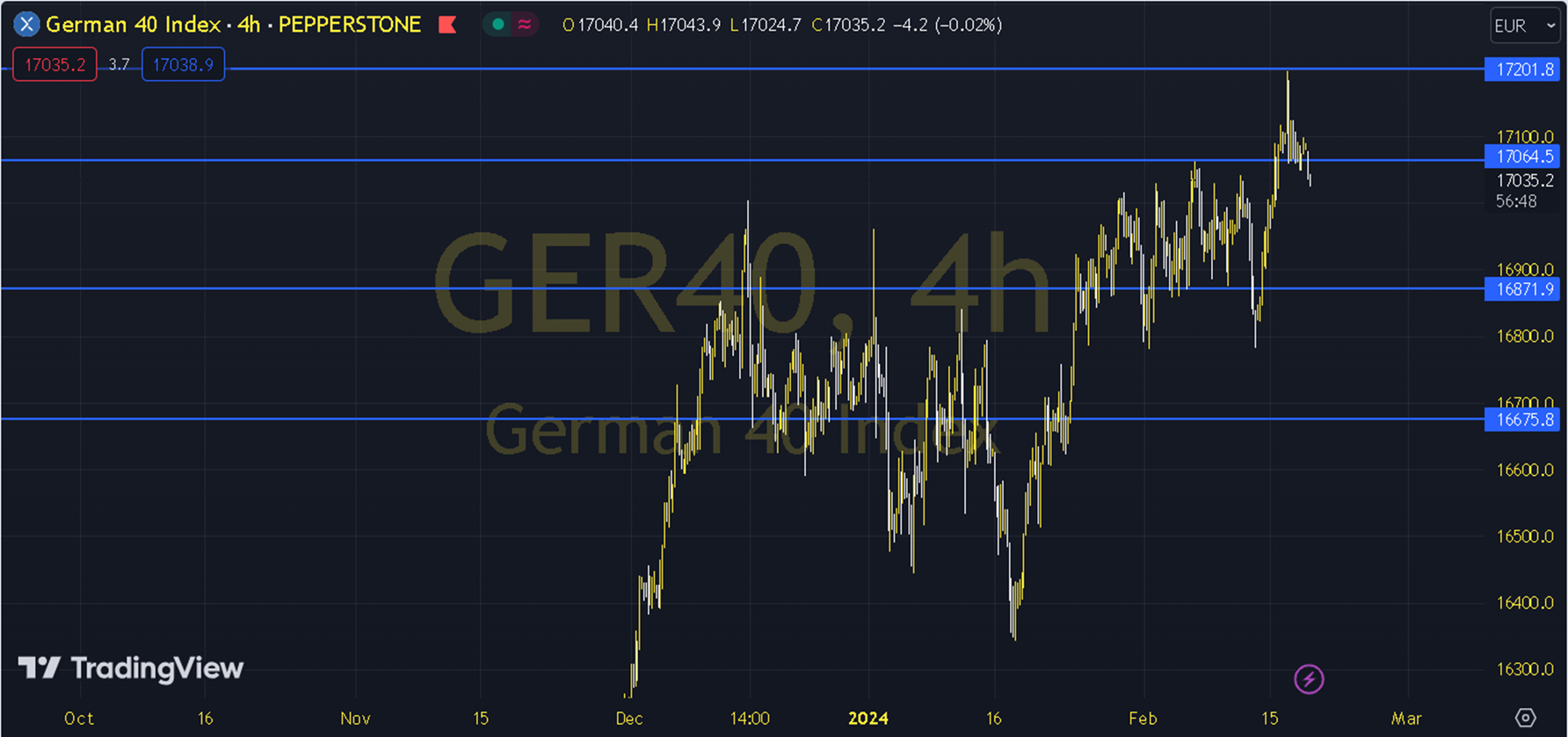

DAXEUR

The previous day, the German 10-year bond yield increased by 0.9 points to 2.41%, while the DAXEUR index completed the day in the negative region, albeit limited. This week, Germany, Eurozone and US PMI data, as well as the FED and ECB monetary policy meeting minutes are among the topics to be followed in terms of the economic calendar. When we examine the short-term chart of the DAXEUR index technically, we are following the 17000 - 17100 region with support from the 20 - 89 period exponential moving average. As long as the index moves within the relevant region, we are following the decision phase scenario. In the increases, increases towards the 17300 level can be seen with the 17200 level being exceeded. In the alternative scenario, in case of possible suppression under the 17200 resistance, the 16900 level and then the 200-period average (16800) levels can be followed as support. Support: 16900 – 16800 Resistance: 17100 – 17200