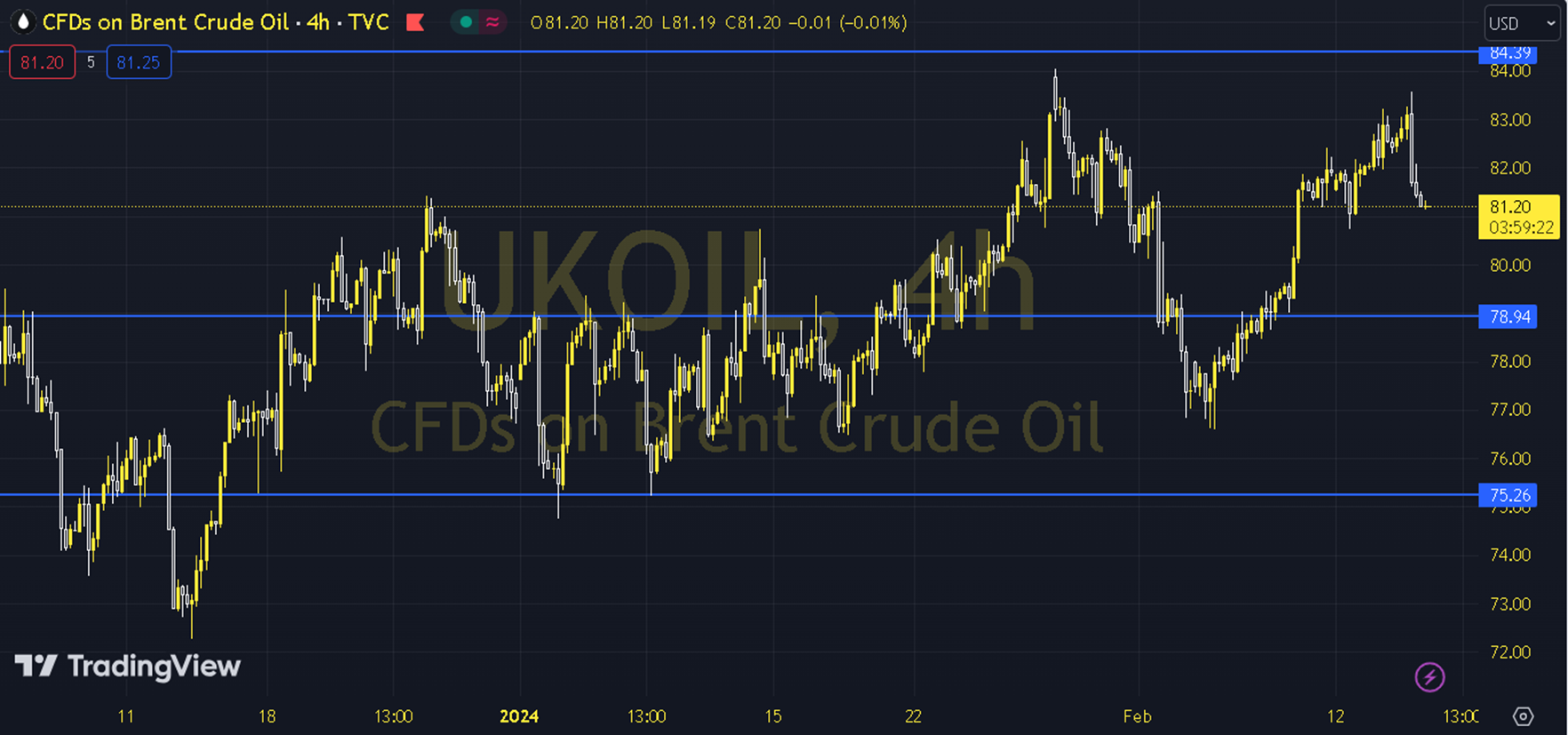

BRENT

Oil prices, which fell with increasing stocks in the US, showed a tendency to recover again by finding support from the high risk appetite in stock markets and geopolitical risks. Signals that OPEC+ is producing in line with the decision to cut also supported this picture. The supply outlook still has a strong outlook compared to the demand side. The course of European and US stock exchanges can be followed during the day. As long as the pricing remains at and above the 82.00 - 82.50 support in the upcoming period, the upward view may be at the forefront. In possible increases, the 83.00 and 83.50 levels can be targeted. As long as possible decreases are limited to the 82.00 - 82.50 support, new upward potential may occur. Therefore, it may be necessary to see the course below 82.00 and hourly closings for the continuation of the downward desire. In this case, the 81.50 and 81.00 levels may come to the agenda. Support: 81.50 Resistance: 83.50