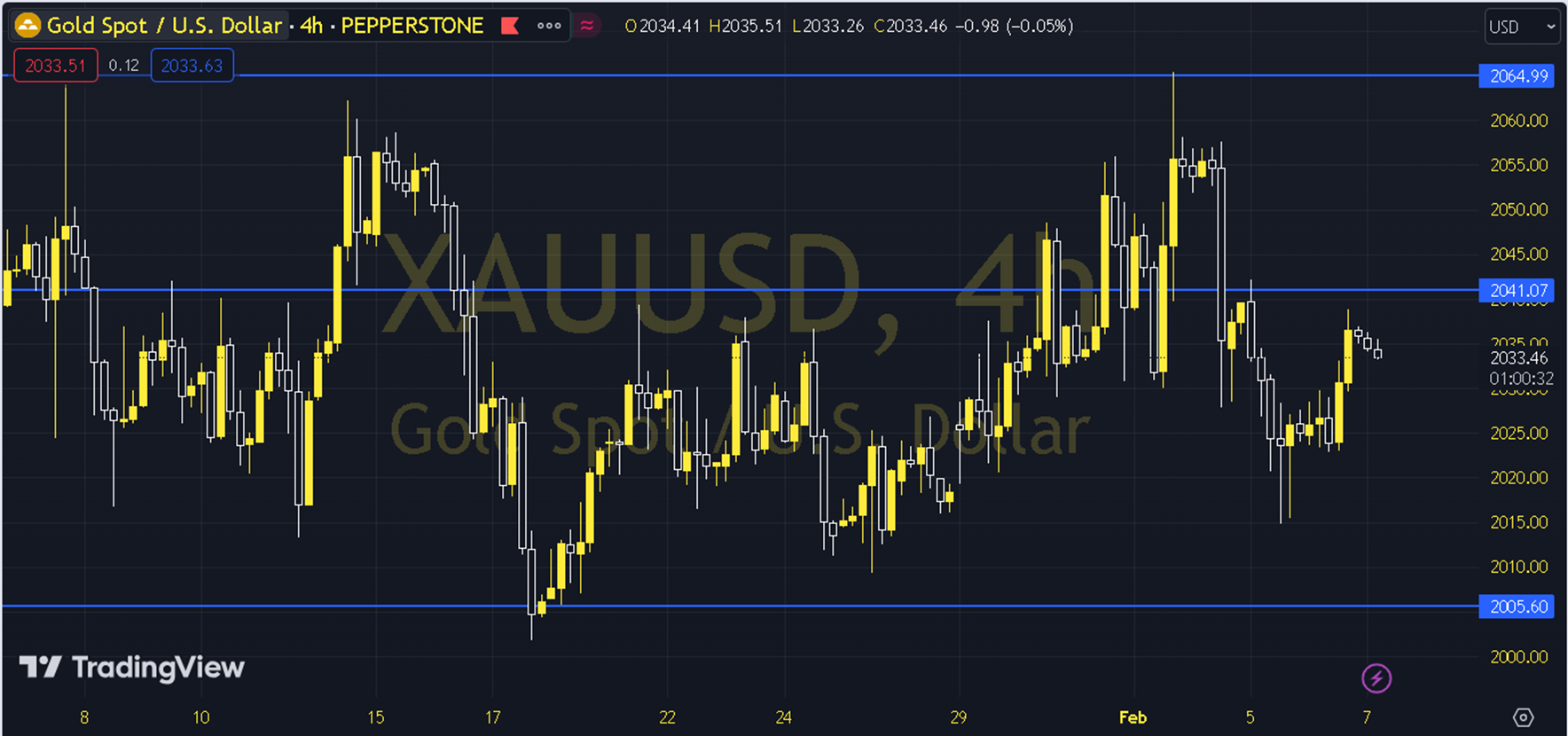

XAUUSD

In the middle of the week; the limited movement of the US 10-year treasury bond yield after falling to around 4.08% allowed it to suppress the recovery of ounce gold in the short term. When we evaluate the short-term gold ounce pricing technically, we are following the 2030 level, which is currently supported by the 34 (2033) period exponential moving average. As long as precious metal pricing is traded below the 2030 level, negative expectations may come to the fore. If the downward trend continues, there may be a movement area towards the 2021 and 2012 levels. In the meantime, the trend line (2017) may draw an appearance that limits the pullback trend. In the alternative case, it may be necessary to see persistence above the 2030 level for the positive trend to come to the fore. In this case, the 2040 and 2052 levels may be encountered in possible increases. Support: 2021-2012 Resistance: 2040-2052